Address

Buy a home

At Florida Homes & Loans Inc, we specialize in helping buyers just like you find the perfect property! Whether you're a first-time homebuyer or looking to upgrade, our expert team is here to guide you every step of the way.

Connect with our agents

Finance a home

Florida Homes & Loans can get you pre-approved so you're ready to make an offer quickly when you find the right home.

NMLS 2295908

Get Pre-Approved

Sell a home

No matter which approach you choose to sell your home, we're here to guide you toward a successful sale.

See your options

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

- Any

- $ 200,000

- $ 300,000

- $ 400,000

- $ 600,000

- $ 1,000,000

- Any

- 1

- 2

- 3

- 4

- 5

- Any

- 1

- 2

- 3

- 4

- 5

- Any

- 1

- 2

- 3

- 4

- 5

- Any

- 1

- 2

- 3

- 4

- 5

10,000+ Properties Available

- Default

- Baths (Most)

- Beds (Most)

- Newest Listings

- Square Feet (Biggest)

- Price-High To Low

- Price-Low To High

- 1/35 35

Pending

Pending$295,000

3 Beds2 Baths1,456 SqFt116 FOREST BLVD, Wildwood, FL 34785

Manufactured Home

Listed by DOWN HOME REALTY, LLLP

- 1/22 22

New

New$295,000

2 Beds2 Baths1,010 SqFt2601 16TH ST, St Cloud, FL 34769

Single Family Home

Listed by FLORIDA REALTY RESULTS LLC

- 1/27 27

New

New$294,990

3 Beds3 Baths1,463 SqFt1540 LUMBAR AVE, Davenport, FL 33896

Townhouse

Listed by DR HORTON REALTY OF CENTRAL FLORIDA LLC

- 1/17 17

New

New$294,900

4 Beds2 Baths2,280 SqFt6274 BOATWRITE RD, Spring Hill, FL 34609

Single Family Home

Listed by MURRAY BELL REAL ESTATE LLC

- 1/83 83

New

New$293,500

3 Beds2 Baths1,188 SqFt26734 DEACON LOOP, Wesley Chapel, FL 33544

Manufactured Home

Listed by KEY LIME REAL ESTATE INC

- 1/35 35

New

New$293,000

4 Beds3 Baths1,888 SqFt2545 OLD KENT CIR, Kissimmee, FL 34758

Townhouse

Listed by ELTIER 1 REALTY LLC

- 1/43 43

New

New$292,000

3 Beds2 Baths1,612 SqFt20 HEMLOCK TRL, Ocala, FL 34472

Single Family Home

Listed by ERA AMERICAN SUNCOAST REALTY

New

New$290,000

2 Beds3 Baths960 SqFt255 SANDLEWOOD TRL #4, Winter Park, FL 32789

Condo

Listed by MAIN STREET PROPERTIES

- 1/28 28

New

New$290,000

3 Beds1 Bath999 SqFt6512 2ND AVE NE, Bradenton, FL 34208

Single Family Home

Listed by REALTY ONE GROUP SUNSHINE

- 1/28 28

Pending

Pending$289,900

3 Beds2 Baths1,481 SqFt100 WELLWATER DR, Palm Coast, FL 32164

Single Family Home

Listed by COASTAL GATEWAY REAL ESTATE GR

- 1/21 21

New

New$289,900

3 Beds2 Baths1,527 SqFt17483 SE 74TH NETHERCLIFT TER, The Villages, FL 32162

Single Family Home

Listed by DOWN HOME REALTY, LLLP

- 1/28 28

New

New$289,900

4 Beds2 Baths1,747 SqFt5485 NW 57TH AVE, Ocala, FL 34482

Single Family Home

Listed by WORLDCORP REALTY

- 1/22 22

New

New$289,900

4 Beds2 Baths1,473 SqFt9471 N FAIRY LILLY DR, Citrus Springs, FL 34433

Single Family Home

Listed by KELLER WILLIAMS CORNERSTONE RE

- 1/20 20

New

New$289,000

2 Beds2 Baths1,276 SqFt142 SOUTHERN PECAN CIR #207, Winter Garden, FL 34787

Condo

Listed by WEMERT GROUP REALTY LLC

- 1/37 37

Price Dropped by $1K

Price Dropped by $1K$288,990

3 Beds2 Baths1,589 SqFt867 PEBBLE CREST LN, Eagle Lake, FL 33839

Single Family Home

Listed by SM FLORIDA BROKERAGE LLC

- 1/25 25

New

New$287,900

3 Beds3 Baths1,291 SqFtKissimmee, FL 34746

Townhouse

Listed by OMEGA REALTY GROUP, LLC.

- 1/2 2

New

New$285,990

3 Beds2 Baths1,243 SqFt467 Garnet ST SW, Palm Bay, FL 32908

Single Family Home

Listed by Holiday Builders Gulf Coast

- 1/18 18

New

New$285,000

2 Beds2 Baths1,058 SqFt1010 VILLAGIO CIR #207, Sarasota, FL 34237

Condo

Listed by O'STEEN GROUP INC

- 1/22 22

New

New$285,000

2 Beds2 Baths1,305 SqFt10810 Eclipse Lily WAY #51a, Orlando, FL 32832

Condo

Listed by RE/MAX Signature

- 1/42 42

New

New$285,000

2 Beds3 Baths1,369 SqFt1107 LAKESHORE DR, Inverness, FL 34450

Single Family Home

Listed by EXP REALTY LLC

- 1/32 32

New

New$285,000

2 Beds2 Baths1,375 SqFt126 CAPRI DR, Palmetto, FL 34221

Manufactured Home

Listed by KELLER WILLIAMS ON THE WATER

- 1/13 13

New

New$285,000

4 Beds2 Baths1,402 SqFt150 RAE DR, Palm Coast, FL 32164

Single Family Home

Listed by EXP REALTY LLC

- 1/42 42

New

New$285,000

3 Beds2 Baths1,768 SqFt1842 SHADY LANE DR, Lake Wales, FL 33898

Single Family Home

Listed by CENTURY 21 AT YOUR SERVICE

- 1/49 49

New

New$285,000

2 Beds2 Baths1,409 SqFt2223 SPRINGMEADOW DR, Spring Hill, FL 34606

Single Family Home

Listed by RE/MAX ALLIANCE GROUP

Read our blogs..

Consumer Guide: Homeowners Insurance Explained

Consumer Guide: Homeowners Insurance Explained

What is homeowners insurance? Homeowners insurance covers you for unexpected losses at your home or property. It can include provisions to repair or rebuild the property, replace assets within the home, cover accidents that happen to you or someone else on the property, or even pay for living expenses if a covered incident forces you to live elsewhere temporarily. How much does homeowners insurance cost, and how do I pay it? The cost of homeowners insurance depends on several factors, including your credit history (in some states), the house’s age, square footage, condition of the property, and location. You may have the option to pay your premium on a monthly, quarterly, or annual basis. Some lenders collect the insurance premium as part of your monthly mortgage payment, place it in an escrow account, and pay the insurer on your behalf. Are homeowners insurance premiums tax deductible? If the property in question is your main home, then your home insurance is generally not deductible. However, people who run a business from their home or those intending to rent out their property may be able to claim a deduction. Additionally, if you suffered a loss to your property caused by a presidentially declared disaster, you may be able to claim a casualty loss deduction. Discuss your unique needs with a tax professional.

MORE:strip_icc():format(webp)/GettyImages-1366196039-0da324a796874f15a8c38caed6a84187.jpg)

7 Spots You're Definitely Forgetting to Clean, According to House Cleaners

7 Spots You're Definitely Forgetting to Clean, According to House Cleaners

7 Spots You're Definitely Forgetting to Clean, According to House Cleaners Giving these places extra attention will make a big difference in your home’s overall cleanliness. By Sophie Flaxman is a home writer at Better Homes & Gardens." data-inline-tooltip="true" data-tooltip-position-x="left" data-tooltip-position-y="top">Sophie Flaxman Photo: FotoDuets / Getty Images When it comes to keeping your home clean, most of us stick to the usual checklist. You know the drill: vacuum the floors, wipe down countertops, and scrub the bathroom. But even the cleanest and tidiest among us can overlook certain areas that collect more grime and dust than we realize. Professional house cleaners, with their sharp eyes and experience, know exactly where to find these hidden trouble spots—and trust us, they're probably not where you’d expect. Read on to discover the top spots people forget to clean, along with top tips from expert cleaners about why giving them extra attention can make a big difference in your home’s cleanliness and overall health. So grab your vacuum and scrub brush and start tackling these sneaky neglected areas. This Monthly Cleaning Checklist Makes Tidying Up So Easy 1. Your Mattress When was the last time you cleaned your mattress? Most people think cleaning their sheets equates to cleaning their bed, but it's actually important to take it a step further. “Even if your bed looks fine on the surface, it’s hiding dust mites, sweat, and dead skin cells you probably haven’t noticed,” says Jade Piper, operations manager for professional cleaning company Better Cleans. Start replacing this old habit with a sparkling new one by investing in a mattress vacuum cleaner with a UVC light feature that mimics the sun's UV rays, eliminating dust mites and killing bacteria. “Start by dealing with stains before vacuuming by blotting them with a mild detergent and water mixture,” Piper says. “Then, gently pass over the mattress surface with a vacuum cleaner to grab loose dirt and pet hair, especially on seams and edges.” This Handheld Vacuum Will Show You Just How Dirty Your Mattress Is—and It’s on Sale for 60% Off 2. Inside The Closet Cleaning out your closet is an important step to make sure your home stays tidy—and we're not just talking about sorting out your clothes. “Closets can easily become a breeding ground for various contaminants, from dust and mold to allergens and bacteria,” says Justin Carpenter, founder of Jacksonville Maids. “Over time, dirt and germs accumulate in this space, affecting your health and comfort.” Clean out your closet by working from top to bottom. Remove all clothing from the shelves and rails so you can wipe them down with a microfiber cloth and disinfectant cleaner. Finish off by vacuuming all the dust and lint off the floor or bottom of the wardrobe and along the baseboards. Once the shelves are dry, start putting your things back neatly, keeping an eye out for anything you no longer want or need. Make this a monthly habit, and you’ll have a fresh, healthy, and Pinterest-worthy wardrobe. 3. Walls and Baseboards Walls might not require the same regular cleaning as the floor, but they can still get pretty dirty over time, especially if you have pets and kids. The accumulation of dust, cobwebs, and grease can lower the air quality in your home, so Piper recommends cleaning your walls at least twice a year and your baseboards monthly. “First, remove cobwebs or dust with a soft-bristled brush or vacuum. Then, mix some mild detergent and warm water in a bucket and use a sponge or microfiber cloth to wipe down the walls,” Piper says. “For stains, you might need to use a special cleaner.” Some products might damage the paintwork, so test it on a small area first. Piper also recommends opting for a washable paint next time you paint your walls. “That way, you can easily wipe away any marks or stains without damaging the paint," she says. 4. Everywhere Above Head Height Don’t forget to look up, especially when you’re cleaning. Some of the most overlooked spots to clean are those above head height: tops of doors and door frames, picture rails, hanging light fixtures, ceiling fans, the top of your fridges, and kitchen cabinets are all commonly-forgotten spaces. Because these spots are hard to see and reach, they’re easily overlooked and require slightly more effort if they've been neglected. Unfortunately, they harbor just as much dust and allergens as everywhere else, so it’s worth getting the ladder out to dust, hoover, and wipe down these areas at least once a month. 5. Inside the Range Hood How clean is your range hood? A build-up of grime and dirt on the hood will lessen its effectiveness and can lead to unwelcome odors or reduced air quality in the kitchen, since pollutants are escaping back into the air. Even if you're cleaning your range hood filter every few months or replacing your charcoal filter twice a year, there's one part of the hood you're probably missing. “While people clean filter surfaces, the back edges often go untouched, says Evie Graham, professional cleaner and founder of Waste Direct. “Our recent testing of 50 homes revealed these edges trap 40% of airborne grease, and they have higher bacterial counts than their bathroom surfaces.” To scrub your range hood properly, use Graham's tried-and-true recipe once every 6 weeks: Mix 2 tablespoons citric acid powder with 500ml warm water, then use the mixture to scrub the hood. “A key step is to let the solution sit for exactly 8 minutes,” she says. “We tested this across 50 commercial kitchens and discovered the timing is crucial.” How to Get Rid of Grease on Your Range Hood 6. Handles, Knobs, and Switches “Hands are major carriers of germs, and things like doorknobs, cabinet handles, and light switches are touched by everyone, all the time, gathering whatever comes into contact with them,” Piper says. These high-touch surfaces collect grime, bacteria, and viruses, making them one of the dirtiest areas in the house, so regular cleaning is essential to reduce the spread of germs and keep your home safe. “Keep them clean with just a quick wipe-down using a surface cleaner or disinfectant wipe,” she says. “Do it every day or a few times a week, and you'll be good to go.” 11 Homemade Cleaners to Make with Ingredients from Your Pantry 7. Under-Sink Water Line Connections Graham shares another niche spot you’ve probably never considered cleaning: your under-sink water line connections. “Our waste water analysis revealed that pipe connection points under sinks harbor significant bacteria,” she says. “Recent scientific testing showed these areas maintain higher humidity than surrounding spaces, even in perfectly-maintained homes. When we implemented regular cleaning of these spots in 20 test homes, the overall kitchen air quality improved by 30%.” After hearing these results, we’ll never skip cleaning the under-sink water line connections again. To improve your home air quality, Graham recommends mixing ten parts white vinegar with 1 part tea tree oil and soaking a thin microfiber cloth. “Wrap connections with the soaked microfiber for 10 minutes before drying them thoroughly, and repeat this monthly," she says. https://www.bhg.com/spots-youre-forgetting-to-clean-8773729

MORE

December 2024 Monthly Housing Market Trends Report

December 2024 Monthly Housing Market Trends Report

December 2024 Monthly Housing Market Trends Report Data, Housing Demand, Housing Supply, Market Outlook Jan 02, 2025 Ralph McLaughlin The number of homes actively for sale continues to be higher compared to last year, growing by 22.0%, a fourteenth straight month of growth, but due to seasonality have plummeted to their lowest level since June. The total number of unsold homes, including homes that are under contract, increased by 17.5% compared with last year. Home sellers slowed down their activity slightly in December, with just 0.9% more homes newly listed on the market compared with last year, down from 2.0% last month. The median price of homes for sale this December was down 1.8 percent compared with last year, at $402,502, however, the median price per square foot grew by 1.3%, indicating that the inventory of smaller and more affordable homes continues to grow in share. Homes spent 70 days on the market, the slowest December in five years and the slowest month since January 2023. This is nine days more than last year and eight more days than last month. The share of listings with price cuts was essentially flat from last year, with 12.9% of sellers cutting prices in the month of December, up slightly from 12.7% in December 2023. According to the Realtor.com® December housing data, the seasonal dive in inventory arrived in December with a month-over-month decrease of 8.6% from November. This is the lowest level since June. The 8.6% month-over-month decrease was the largest monthly decrease since January 2023. What’s more, we find that high mortgage rates continue to bring a slow market, with December 2024 being the slowest December since 2019 and the slowest month in nearly two years. December Brings Strongest Seasonal Slowdown in Nearly Two Years There were 22.0% more homes actively for sale on a typical day in December compared with the same time in 2023, marking the fourteenth consecutive month of annual inventory growth. However, this is a sharp deceleration from November, which was up 26.2% year-over-year. This is the fifth consecutive month where the rate of growth has decreased from the prior month. What’s more, the 8.6% drop from November to December was the largest month-over-month decrease since January 2023. While inventory this December certainly continues to improve, it is still down 15.7% compared with typical 2017 to 2019 levels. This is a large decrease from last month’s 21.5% gap. The total number of homes for sale, including homes that were under contract but not yet sold, increased by 17.5% compared with last year, growing on an annual basis for the 12th month in a row. This is down from 22.5% last month. The number of homes under contract but not yet sold (pending listings) continued to rebound in December, increasing by 7.4% compared with last year, just under 50% less than November’s 14.7% gain. The slowdown is partly due to higher mortgage rates. In November and December, rates were about 40–50 basis points higher than in September and October. Though rates are significantly higher today than they were just a few months ago, our 2025 forecast shows that as both lower rates and time chisel away at the “lock-in” effect that has held back sales this year, we should expect home sales to rise modestly by 1.5% in 2025. Sellers slightly increased their activity this December as newly listed homes were just 0.9% above last year’s levels, a decrease from November’s rise of 2%. Last month, we mentioned that the drop in mortgage rates in mid-August might increase listings. Lower rates can encourage some homeowners to sell. That is exactly what happened in September and October. But with higher rates taking a bite out of homebuying power, fewer new sellers are coming to the market this winter compared with this past fall. Regional and metro area inventory trends The South and West are closest to bridging the inventory gap In December, all four regions continued to see active inventory grow over the previous year. The South saw listings grow by 26.7%, while inventory grew by 23.7% in the West, 15.2% in the Midwest, and 6.9% in the Northeast. Compared with the typical December from 2017 to 2019, before the COVID-19 pandemic, the South fully closed the gap in inventory, up 0.1% compared with pre-pandemic levels. Meanwhile, the gap was 4% in the West, and much larger in the Midwest and Northeast, at 36.5% and 48.7%, respectively. With the exception of San Jose, CA, the inventory of homes for sale increased in all of the largest metros compared with last year. Metros that saw the most inventory growth included Miami (+45.4%), Orlando (+42.4%), and Denver (+41.9%). Despite higher inventory growth compared with last year, most metros still had a lower level of inventory when compared with pre-pandemic years. Among the 50 largest metro areas, 16 saw higher levels of inventory in December compared with typical 2017 to 2019 levels. This is the same number as last month. The top metros that saw inventory surpass pre-pandemic levels were predominantly in the South and included Memphis (+37.7%), Austin (+36.5%), and Orlando (+34.9%). The South saw newly listed homes increase the most compared with last year New home listings went up by 4.8% in the South and 2% in the West. However, they dropped by 5.6% in the Northeast and 6.6% in the Midwest. The gap in newly listed homes compared with pre-pandemic 2017 to 2019 levels was also the lowest in the South, where newly listed homes were just 1.6% below pre-pandemic levels. In comparison, they were down 12.4% in the Midwest, 19.7% in the Northeast, and 25.5% in the West. In December, 22 of the 50 largest metros saw new listings increase over the previous year, down from 32 last month. However, just seven large metros—including Houston, Birmingham, and Miami—saw more newly listed homes this December compared with the typical pace of new listings from December 2017 to 2019. This is up from four large metros in the prior month. The metros that saw the largest growth in newly listed homes compared with last year included Atlanta (+17.8%), Birmingham, (+17.1%), and Virginia Beach (+16.9%). Homes are spending more time on the market compared with last year, but less than pre-pandemic levels The typical home spent 70 days on the market this December, which is nine more days than the same time last year and eight more days than last month. This marks the slowest December since 2019 and the slowest month since January 2023, marking the ninth month in a row where homes spent more time on the market compared with the previous year. However, the time a typical home spends on the market is still eight days less than the average December from 2017 to 2019. Regional and metro area time on the market trends In the South, where the growth in home inventory has been the largest, the typical home spent 10 more days on the market in December compared with last year. Out West, homes are staying on the market eight days longer. However, in the Midwest and Northeast, homes are staying on the market just four and five more days, respectively, than the same time last year. While three regions were still seeing time on the market below pre-pandemic levels, homes in the West are now spending one more day on the market compared with the typical December from 2017 to 2019. Time on the market was four days less than pre-pandemic levels in the South, 17 days less in the Midwest, and 19 days less in the Northeast. Meanwhile, time on the market increased compared with last year in 46 of the 50 largest metro areas this December, up from 42 last month. It increased the most in Nashville (+22 days), Orlando (+21 days), and Rochester (+21 days). Fourteen markets saw homes spend more time on the market than typical 2017 to 2019 pre-pandemic timing, with a few notable standouts: Nashville (+22 days), Orlando (+22 days), and Rochester (+21 days). The median list price was down slightly from last December, but the price per square foot continues to rise The national median list price in December was at $402,502, which is about $15,000 lower than last month and 1.8% lower than last December. However, when a change in the mix of inventory toward smaller homes is accounted for, the typical home listed this year has increased in asking price compared with last year. The median listing price per square foot increased by 1.3% in December compared with the same time last year. Moreover, the typical listed home price has grown by 34.2% compared with December 2019, while the price per square foot grew by 49.5%. The percentage of homes with price reductions was up 0.2% from last year, at 12.9%. What’s more, the overall share of inventory with price cuts is +2.4pp higher than the shares seen between December 2017 and December 2019, up from +1.4pp last month. Regional and metro area price trends In December, listing prices were up compared with December 2023 in the Midwest and Northeast, at 0.7% and 0.4%, respectively. Listing prices fell by 1.3% and 2.3% in the West and South. Controlling for the mix of homes on the market by looking at price per square foot, all regions showed greater growth rates of 0.3% to 3.9%. Among large metros, the median list price in Cleveland (+9.1%), Milwaukee (+6.7%), and Detroit (+6.2%) saw the biggest increases. Meanwhile, all 50 of the largest metropolitan areas have seen sizable price growth compared with homes listed before the pandemic. Compared with December 2019, the price-per-square-foot growth rate in the 50 largest metros ranged from 17.9% to 66.8%. Sellers saw the biggest price increases per square foot in these markets: Hartford metro area (+66.8% since December 2019), New York (+66.8%), and Nashville (+60.3%). Markets that saw the lowest return included San Francisco (+17.9%), San Jose (+24.0%), and New Orleans (+25.5%). Compared with last year, price reductions were down 0.8 percentage points in the Northeast and 0.4 percentage points in the Midwest, but up 0.1 percentage points in the South and 1.5 percentage points in the West. Of the 50 largest metros, 26 saw the share of price reductions increase compared with last December, up from 11 in November. Denver had the biggest increase at +11.5 percentage points. Portland, OR, followed with +8.7 percentage points. Providence came next with +7.8 percentage points. December 2024 Regional Statistics Region Active Listing Count YoY New Listing Count YoY Median Listing Price YoY Median Listing Price Per SF YoY Median Days on Market Y-Y (Days) Price-Reduced Share Y-Y (Percentage Points) Midwest 15.2% -6.6% 0.7% 3.0% 4 -0.4 pp Northeast 6.9% -5.6% 0.4% 3.9% 5 -0.8 pp South 26.7% 4.8% -2.3% 0.3% 10 +0.1 pp West 23.7% 2.0% -1.3% 1.6% 8 +1.5 pp December 2024 Housing Overview of the 50 Largest Metros Metro Area Median Listing Price Median Listing Price YoY Median Listing Price per Sq. Ft. YoY Median Listing Price vs December 2019 Median Listing Price per Sq. Ft. vs December 2019 Atlanta-Sandy Springs-Alpharetta, Ga. $399,950 -3.6% -0.6% 25.8% 47.9% Austin-Round Rock-Georgetown, Texas $498,500 -7.7% -5.3% 42.4% 51.8% Baltimore-Columbia-Towson, Md. $350,000 1.4% 0.9% 15.5% 27.8% Birmingham-Hoover, Ala. $289,788 0.0% 0.0% 14.1% 28.6% Boston-Cambridge-Newton, Mass.-N.H. $801,383 0.2% 3.4% 36.0% 56.6% Buffalo-Cheektowaga, N.Y. $249,950 0.4% 4.0% 31.6% 46.5% Charlotte-Concord-Gastonia, N.C.-S.C. $422,450 5.6% 1.2% 25.8% 54.8% Chicago-Naperville-Elgin, Ill.-Ind.-Wis. $347,450 -0.7% 1.9% 16.2% 31.1% Cincinnati, Ohio-Ky.-Ind. $319,050 -4.8% 3.4% 23.2% 50.5% Cleveland-Elyria, Ohio $239,950 9.1% 13.9% 33.4% 52.8% Columbus, Ohio $349,450 -2.9% 3.3% 27.1% 52.6% Dallas-Fort Worth-Arlington, Texas $422,450 -2.9% -0.3% 25.1% 41.7% Denver-Aurora-Lakewood, Colo. $577,350 -5.4% -1.1% 16.1% 34.1% Detroit-Warren-Dearborn, Mich. $249,900 6.2% 1.4% 11.1% 27.1% Hartford-East Hartford-Middletown, Conn. $399,900 2.6% 12.9% 37.9% 66.8% Houston-The Woodlands-Sugar Land, Texas $361,405 0.4% -0.3% 20.5% 36.4% Indianapolis-Carmel-Anderson, Ind. $309,900 1.6% 2.4% 21.2% 49.6% Jacksonville, Fla. $384,500 -5.7% -2.2% 28.2% 45.9% Kansas City, Mo.-Kan. $369,995 -7.5% -1.2% 17.9% 37.9% Las Vegas-Henderson-Paradise, Nev. $468,450 1.9% 4.6% 46.5% 53.9% Los Angeles-Long Beach-Anaheim, Calif. $1,094,000 -0.5% 1.6% 29.5% 42.8% Louisville/Jefferson County, Ky.-Ind. $304,998 1.7% 1.9% 27.1% 37.7% Memphis, Tenn.-Miss.-Ark. $329,960 3.5% -0.4% 41.9% 57.6% Miami-Fort Lauderdale-Pompano Beach, Fla. $522,500 -9.9% -6.6% 30.7% 39.8% Milwaukee-Waukesha, Wis. $357,450 6.7% 8.5% 41.0% 46.6% Minneapolis-St. Paul-Bloomington, Minn.-Wis. $423,198 0.7% -0.1% 20.9% 28.0% Nashville-Davidson-Murfreesboro-Franklin, Tenn. $537,450 -3.9% 0.2% 46.2% 60.3% New Orleans-Metairie, La. $325,000 0.0% -1.2% 16.7% 25.5% New York-Newark-Jersey City, N.Y.-N.J.-Pa. $749,000 2.0% 1.5% 30.4% 66.8% Oklahoma City, Okla. $309,950 -3.1% -0.1% 24.0% 37.5% Orlando-Kissimmee-Sanford, Fla. $419,950 -4.3% -2.4% 32.5% 51.4% Philadelphia-Camden-Wilmington, Pa.-N.J.-Del.-Md. $358,075 5.3% 5.4% 25.4% 48.9% Phoenix-Mesa-Chandler, Ariz. $499,995 -5.1% 0.6% 31.6% 49.4% Pittsburgh, Pa. $235,000 -1.7% 3.2% 23.7% 30.8% Portland-Vancouver-Hillsboro, Ore.-Wash. $597,000 -0.5% 0.5% 28.0% 38.1% Providence-Warwick, R.I.-Mass. $524,950 5.0% 5.9% 41.9% 44.1% Raleigh-Cary, N.C. $444,498 -0.4% 1.0% 23.5% 49.6% Richmond, Va. $419,950 -2.3% 2.9% 30.1% 55.0% Riverside-San Bernardino-Ontario, Calif. $597,000 3.1% 0.9% 47.4% 56.2% Rochester, N.Y. $257,400 3.0% 4.4% 28.8% 38.2% Sacramento-Roseville-Folsom, Calif. $615,000 -1.6% -0.5% 24.2% 34.6% San Antonio-New Braunfels, Texas $329,950 -1.7% -1.9% 18.3% 33.7% San Diego-Chula Vista-Carlsbad, Calif. $964,725 -1.6% -0.5% 34.5% 52.6% San Francisco-Oakland-Berkeley, Calif. $889,500 -10.9% -6.5% -1.1% 17.9% San Jose-Sunnyvale-Santa Clara, Calif. $1,268,500 -2.3% -0.9% 17.0% 24.0% Seattle-Tacoma-Bellevue, Wash. $724,475 -3.3% 2.0% 24.9% 46.6% St. Louis, Mo.-Ill. $277,450 0.9% -0.1% 32.0% 27.4% Tampa-St. Petersburg-Clearwater, Fla. $395,000 -6.0% -5.5% 41.3% 56.9% Virginia Beach-Norfolk-Newport News, Va.-N.C. $387,450 3.3% 5.2% 29.6% 45.6% Washington-Arlington-Alexandria, DC-Va.-Md.-W. Va. $572,500 -2.1% 3.4% 21.8% 51.5% Metro Area Active Listing Count YoY New Listing Count YoY Median Days on Market Median Days on Market Y-Y (Days) Price- Reduced Share Price-Reduced Share Y-Y (Percentage Points) Atlanta-Sandy Springs-Alpharetta, Ga. 38.3% 17.8% 65 12 16.2% +3.2 pp Austin-Round Rock-Georgetown, Texas 13.0% -14.2% 80 6 16.1% -3.9 pp Baltimore-Columbia-Towson, Md. 17.5% 5.4% 49 3 12.3% -0.7 pp Birmingham-Hoover, Ala. 19.0% 17.1% 69 8 12.6% -2.5 pp Boston-Cambridge-Newton, Mass.-N.H. 1.1% -18.2% 60 7 8.9% -0.2 pp Buffalo-Cheektowaga, N.Y. 17.0% -14.1% 61 2 5.8% +0.3 pp Charlotte-Concord-Gastonia, N.C.-S.C. 33.6% 3.6% 63 10 16.0% +3.1 pp Chicago-Naperville-Elgin, Ill.-Ind.-Wis. 6.4% 11.8% 51 1 10.2% -1.8 pp Cincinnati, Ohio-Ky.-Ind. 18.2% -11.0% 52 8 12.5% 1.5 pp Cleveland-Elyria, Ohio 3.7% -19.1% 55 4 13.0% -0.7 pp Columbus, Ohio 24.9% -1.5% 56 7 17.7% -0.3 pp Dallas-Fort Worth-Arlington, Texas 31.1% 14.7% 66 8 17.4% +0.0 pp Denver-Aurora-Lakewood, Colo. 41.9% 0.8% 74 13 24.1% +11.5 pp Detroit-Warren-Dearborn, Mich. 8.0% -1.6% 50 -1 11.8% -0.4 pp Hartford-East Hartford-Middletown, Conn. 3.4% -9.0% 49 4 7.4% +0.6 pp Houston-The Woodlands-Sugar Land, Texas 24.5% 9.0% 59 3 13.6% +0.5 pp Indianapolis-Carmel-Anderson, Ind. 12.1% 0.4% 60 3 16.9% -2.2 pp Jacksonville, Fla. 36.8% 2.5% 78 17 17.9% +2.9 pp Kansas City, Mo.-Kan. 12.2% 1.6% 68 4 11.6% +1.7 pp Las Vegas-Henderson-Paradise, Nev. 41.5% 16.3% 63 9 15.5% +0.7 pp Los Angeles-Long Beach-Anaheim, Calif. 26.3% -7.1% 63 9 9.0% +1.5 pp Louisville/Jefferson County, Ky.-Ind. 13.4% 11.2% 51 3 15.3% -2.7 pp Memphis, Tenn.-Miss.-Ark. 18.5% -10.2% 73 10 15.5% -3.0 pp Miami-Fort Lauderdale-Pompano Beach, Fla. 45.4% 11.3% 79 18 14.7% +0.7 pp Milwaukee-Waukesha, Wis. 6.0% -16.0% 45 1 11.6% -3.1 pp Minneapolis-St. Paul-Bloomington, Minn.-Wis. 8.0% 0.5% 59 5 10.1% -0.3 pp Nashville-Davidson-Murfreesboro-Franklin, Tenn. 17.1% 3.6% 66 22 11.9% -3.1 pp New Orleans-Metairie, La. 12.4% -11.6% 83 6 12.3% -0.3 pp New York-Newark-Jersey City, N.Y.-N.J.-Pa. 0.3% 6.4% 73 2 4.6% -1.3 pp Oklahoma City, Okla. 28.4% -4.1% 58 0 15.2% -2.6 pp Orlando-Kissimmee-Sanford, Fla. 42.4% -8.5% 80 22 17.0% +0.4 pp Philadelphia-Camden-Wilmington, Pa.-N.J.-Del.-Md. 6.4% -5.9% 57 1 10.9% -1.1 pp Phoenix-Mesa-Chandler, Ariz. 32.8% 5.2% 66 13 21.2% +0.3 pp Pittsburgh, Pa. 14.4% -10.0% 69 3 12.2% -1.0 pp Portland-Vancouver-Hillsboro, Ore.-Wash. 13.0% -6.7% 80 14 20.8% +8.7 pp Providence-Warwick, R.I.-Mass. 4.3% -9.2% 49 4 16.6% +7.8 pp Raleigh-Cary, N.C. 27.0% -1.8% 70 7 11.6% +0.7 pp Richmond, Va. 10.1% 2.2% 54 0 10.5% +1.5 pp Riverside-San Bernardino-Ontario, Calif. 32.8% -1.9% 66 7 11.1% +0.4 pp Rochester, N.Y. 1.4% -27.6% 56 21 3.9% -5.9 pp Sacramento-Roseville-Folsom, Calif. 22.1% -8.2% 62 10 11.8% +0.9 pp San Antonio-New Braunfels, Texas 16.1% 3.8% 74 6 17.7% -0.8 pp San Diego-Chula Vista-Carlsbad, Calif. 41.2% 0.0% 55 11 10.9% +0.2 pp San Francisco-Oakland-Berkeley, Calif. 14.0% -3.6% 64 6 7.9% +0.4 pp San Jose-Sunnyvale-Santa Clara, Calif. -1.0% -18.5% 50 7 7.2% +1.1 pp Seattle-Tacoma-Bellevue, Wash. 18.1% -7.4% 63 6 10.5% +1.2 pp St. Louis, Mo.-Ill. 9.6% -3.2% 58 5 12.9% +1.4 pp Tampa-St. Petersburg-Clearwater, Fla. 27.0% 8.0% 72 15 19.6% -0.2 pp Virginia Beach-Norfolk-Newport News, Va.-N.C. 17.7% 16.9% 47 2 14.4% -3.2 pp Washington-Arlington-Alexandria, DC-Va.-Md.-W. Va. https://www.realtor.com/research/december-2024-data/?distinct_id=hYtR6AyJa&user_email=gemma%40flhomeandloan.com Data, Housing Demand, Housing Supply, Market Outlook Jan 02, 2025 Ralph McLaughlin

MORE

Owners of HOA Property in Florida Face Challenges After Disasters

Owners of HOA Property in Florida Face Challenges After Disasters

Owners of HOA Property in Florida Face Challenges After Disasters When your condo is damaged or destroyed, are you still responsible for HOA fees?The short answer: Yes, in most cases. Understanding HOA Fees After a Disaster Even if your condominium is severely damaged or uninhabitable, homeowners are often still required to pay HOA fees. According to Chad D. Cummings, CEO of Cummings & Cummings Law in Naples, FL, “The general rule in Florida—and most other jurisdictions—is that HOA dues remain owed even if the property is no longer livable due to events like hurricanes or fires.” This is because HOA fees typically cover shared community expenses such as insurance for common areas, property taxes, and ongoing maintenance. These financial obligations don’t disappear even if an individual property is damaged. “Those types of expenses will likely continue to come due even if the property has been destroyed,” explains Eric Teusink, managing partner of Williams Teusink in Atlanta. What Happens If You Don’t Pay HOA Fees? Florida law permits HOAs to take action against homeowners who fail to pay their dues. This can include filing liens or even pursuing foreclosure after proper notice is given. Additionally, late fees, interest, and administrative penalties may be applied to unpaid balances. While such actions are legal, they may face public backlash, particularly in disaster scenarios. Teusink notes, “HOAs have a moral duty to work with homeowners affected by disasters, and legal counsel should encourage them to consider leniency in such cases.” HOAs vs. CDDs in Florida: What’s the Difference? Florida communities commonly feature both Homeowners Associations (HOAs) and Community Development Districts (CDDs). While both manage community operations, they serve distinct purposes. HOA Overview An HOA is an organization that establishes community rules and oversees shared amenities. Membership is typically required, and fees are used for: Landscaping and lawn care Water, trash collection, and shared utilities Maintenance of common areas like pools and clubhouses Insurance and property taxes for community property HOAs may also charge special assessments for unexpected expenses, such as roof repairs or emergency fixes after a storm. CDD Overview A Community Development District (CDD) is a government-authorized district that funds large-scale infrastructure projects, such as roads, utilities, and community amenities. Unlike HOA fees, CDD fees are included in your annual property tax bill and are often tax-deductible. Example: The Villages in Florida, one of the fastest-growing communities in the U.S., is a CDD. Residents pay fees to fund amenities and infrastructure like parks, golf courses, and public services. Is Living in an HOA or CDD Better? Choosing between an HOA or a CDD community in Florida depends on your priorities: HOAs: Best for those who prefer structured rules, well-maintained neighborhoods, and steady property values. CDDs: Often feature lower home prices due to deferred infrastructure costs but come with higher property taxes and fewer restrictions on how you use your property. “Some say HOAs stand for ‘hostile environments, ornery neighbors, and anger-infused management,’” jokes Lee Davenport, a real estate coach and fair housing educator. She advises buyers to carefully review HOA rules and regulations before purchasing to avoid surprises. Meanwhile, CDDs may offer more flexibility, making them a better fit for homeowners who value fewer restrictions over strict oversight. The Bottom Line Whether you’re choosing between an HOA or a CDD, it’s essential to research thoroughly. Understanding the financial obligations, rules, and benefits of your community will help you make an informed decision that suits your lifestyle and long-term goals.

MORE

What Is Condo Insurance and What Does It Cover?

What Is Condo Insurance and What Does It Cover?

What Is Condo Insurance and What Does It Cover? Condo insurance, also known as HO-6 insurance, is a specialized policy designed to protect condominium owners. It works alongside the condo association’s master insurance policy to provide comprehensive coverage for your unit and belongings. What Does Condo Insurance Cover? 1️⃣ Interior of Your Unit Covers the walls, flooring, ceilings, and fixtures within your condo. If a fire, vandalism, or another covered event damages your unit, condo insurance helps with repairs. 2️⃣ Personal Belongings Protects your furniture, clothing, electronics, and other personal items against theft, fire, or water damage. 3️⃣ Liability Coverage Provides financial protection if someone is injured in your condo and decides to sue. It also covers accidental damage you may cause to someone else’s property. 4️⃣ Loss of Use Covers additional living expenses, like hotel stays or meals, if your condo becomes uninhabitable due to a covered event. 5️⃣ Building Property Coverage Covers upgrades and improvements you’ve made to your unit, such as custom cabinets or new flooring, that aren’t included in the condo association’s master policy. 6️⃣ Loss Assessment Helps pay for your share of a loss when the condo association’s master policy doesn’t fully cover damage to shared areas like the roof, lobby, or pool. What’s Not Covered? Condo insurance typically doesn’t cover: Damage to shared areas (covered by the condo association’s master policy) Floods or earthquakes (separate policies may be needed) Maintenance-related issues (e.g., wear and tear or mold) Why Do You Need Condo Insurance? While the condo association’s master policy covers the building’s structure and common areas, it doesn’t protect your personal property, the interior of your unit, or liability risks. Condo insurance bridges that gap, offering you financial peace of mind. 📩 Need help choosing the right condo insurance? Let’s talk!#CondoInsurance #HomeProtection #HO6Policy #SmartHomeownership

MORE

Mortgage Rates vs. The Fed: Explained Like You’re in 8th Grade!

Mortgage Rates vs. The Fed: Explained Like You’re in 8th Grade!

🎓 Mortgage Rates vs. The Fed: Explained Like You’re in 8th Grade! 🏡 Ever wonder why mortgage rates don’t always drop when the Fed cuts rates? Let’s break it down: 1️⃣ The Fed’s Job and Its RateThe Fed sets a “wholesale” rate for banks when they borrow money overnight. This impacts short-term stuff like credit cards. Mortgage rates? They’re more like a “long-term” deal and follow different rules. 2️⃣ What Really Affects Mortgage RatesMortgage rates are like house prices—they depend on what’s happening in the economy: Inflation (prices rising) 🛍️ Jobs (how many people are working) 💼 Economic growth 📈 3️⃣ Why Mortgage Rates Don’t Always DropWhen the Fed lowers its rate, people expect mortgage rates to drop. But investors set mortgage rates based on what they think will happen in the future. If inflation or economic struggles are still a concern, mortgage rates might not budge. 4️⃣ Timing is KeySometimes, mortgage rates move before the Fed does. It’s like hearing a new video game will go on sale—stores might lower prices early, so by the time the sale hits, there’s not much change left. 💡 The Big IdeaThe Fed’s rate and mortgage rates are like distant cousins—they’re connected but don’t always move together. Mortgage rates follow the bigger economic picture, and they might take a different path.

MORE

Why are our rates so low?

1. WE SHOP RATES FOR EVERY LOAN: We compare rates from 198 lenders in real-time for you.

2. WE NEGOTIATE FOR YOU: Because we have closed so many loans, we can negotiate and obtain ridiculously low rates from lenders.

3. WE LOWER OUR PROFIT: Our profit per loan is much lower than that of our competitors. We aim to earn your business and your referrals.

By checking this box, I agree by electronic signature to (1) the Electronic Disclosure Consent; (2) receive recurring marketing communication from or on behalf of Gemma Peterson, including auto-dialed calls, texts, and prerecorded messages (consent not required to make a purchase; data rates may apply; reply "STOP" to opt-out of texts or "HELP" for help); and (3) the Terms of Service and Privacy Policy of this website. I understand that I can call +1(407) 242-7758 to obtain direct assistance.

Why Choose Us

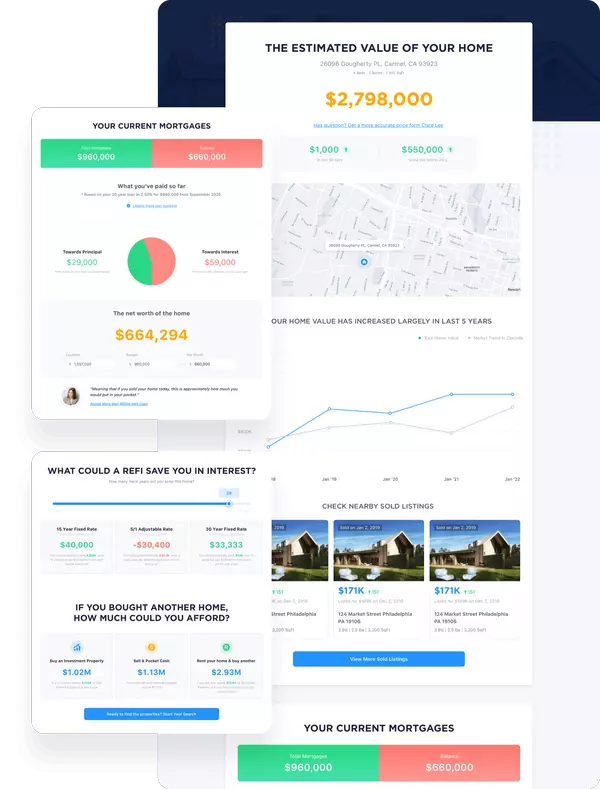

Free & Instant Home Valuation

Estimate how much you can get by selling your home and keep track as the market changes.

Sell Faster

Our team utilizes the power of online marketing to sell faster than an average real estate agent.

Save Money

Our experts help you sell for the highest price point possible.