Receive a copy of our homebuyer's handbook

Frequently Asked Questions in regards to the Buyer agreements

Can I work with other agents if I sign a buyer agreement?

Typically, a buyer agreement is exclusive, meaning you agree to work only with the agent specified in the agreement. If you wish to work with multiple agents, this should be clearly stated in the agreement, although most agreements prefer exclusivity to avoid conflicts of interest.

What happens if I’m not satisfied with my agent’s services?

If you’re not satisfied with your agent’s services, you should first discuss your concerns with them. If the issue cannot be resolved, most agreements have a termination clause that outlines how you can end the agreement. Be sure to review this clause before signing.

What should I do before signing a buyer agreement?

Before signing a buyer agreement, carefully review all the terms and conditions. Ask questions about anything that is unclear, and don’t hesitate to negotiate terms that better suit your needs. It may also be wise to consult with a legal professional.

How is the Buyer-Broker compensation determined?

The Buyer-Broker compensation is determined between the Buyer and the Buyer-Broker. The fee is negotiable and there is no standard fee fixed by law.

How is the Buyer-Broker commission

fee paid?

The Buyer-Broker commission fee is paid directly to the buyer’s broker using funds collected at escrow. This payment can be sourced either from the buyer, the seller, or depending on the concessions agreed upon in writing.

Why is signing a buyer agreement necessary?

Signing a buyer agreement is necessary to establish a clear, professional relationship between the buyer and the real estate agent. It ensures both parties understand their roles and obligations, which can help prevent misunderstandings and disputes during the buying process.

What if the Buyers want to look at more than one property?

There are several options. If there are only 1 or 2 properties, the additional address may be placed in the additional terms. Agents and their Buyer(s) may opt to “upgrade” to a more encompassing buyer broker agreement that would allow for more properties, longer time frame or specific zip code.

What is the new buyer agreement required by NAR?

The new buyer agreement is a formal contract that outlines the responsibilities and expectations between a buyer and their real estate agent. It ensures transparency and clarifies the terms of the relationship, including the agent’s duties, commission structure, and the duration of the agreement.

Other Questions you may have as a buyer...

How much can I afford to spend on a home?

Determining how much you can afford depends on your income, debt, credit score, and the amount you have saved for a down payment. A general rule is to keep your mortgage payment (including taxes and insurance) at or below 30% of your monthly income. It’s advisable to get pre-approved for a mortgage to understand your budget more clearly.

What is a mortgage pre-approval, and why is it important?

A mortgage pre-approval is a lender's conditional approval for a specific loan amount based on your financial situation. It’s important because it shows sellers that you are a serious buyer with the financial means to purchase a home, giving you an edge in competitive markets.

What are the different types of mortgages available?

Common mortgage types include fixed-rate mortgages (where the interest rate stays the same throughout the loan term) and adjustable-rate mortgages (where the rate can change after a certain period). Government-backed loans like FHA, VA, and USDA loans may be available, depending on your eligibility.

How much do I need for a down payment?

The down payment amount varies depending on the loan type and the lender’s requirements. Generally, down payments range from 3% to 20% of the home’s purchase price. Some loans, like VA and USDA loans, may offer zero down payment options for eligible buyers.

What are closing costs, and how much should I expect to pay?

Closing costs are fees associated with finalizing a home purchase and can include origination fees, appraisal fees, title insurance, and more. They typically range from 2% to 5% of the home’s purchase price. It’s important to budget for these costs in addition to your down payment.

What does the home-buying process involve?

The home-buying process generally includes the following steps: getting pre-approved for a mortgage, finding a real estate agent, searching for homes, making an offer, getting a home inspection, securing financing, and closing on the home. Each step is crucial to ensuring a smooth transaction.

How important is my credit score in the home-buying process?

Your credit score is very important as it affects your ability to qualify for a mortgage and the interest rate you’ll receive. Higher credit scores generally lead to better loan terms. If your score is low, you might want to take steps to improve it before applying for a mortgage.

What should I consider when choosing a neighborhood?

When choosing a neighborhood, consider factors like proximity to work, school quality, safety, local amenities, property taxes, and future development plans. Visiting the neighborhood at different times of day can also help you get a better sense of the area.

What are property taxes, and how do they affect my monthly payment?

Property taxes are taxes paid to local governments based on the assessed value of the property. They are typically included in your monthly mortgage payment along with your homeowner’s insurance. It’s important to factor in property taxes when budgeting for a home.

What are some hidden costs of homeownership?

Hidden costs of homeownership can include maintenance and repair expenses, homeowner’s association (HOA) fees, utilities, and property taxes. It’s important to budget for these ongoing costs in addition to your mortgage payment.

Should I buy a home now or wait?

Whether to buy now or wait depends on your financial situation, the real estate market, and your personal circumstances. Consider factors like interest rates, home prices, and how long you plan to stay in the home. Consulting with a real estate professional can help you make an informed decision.

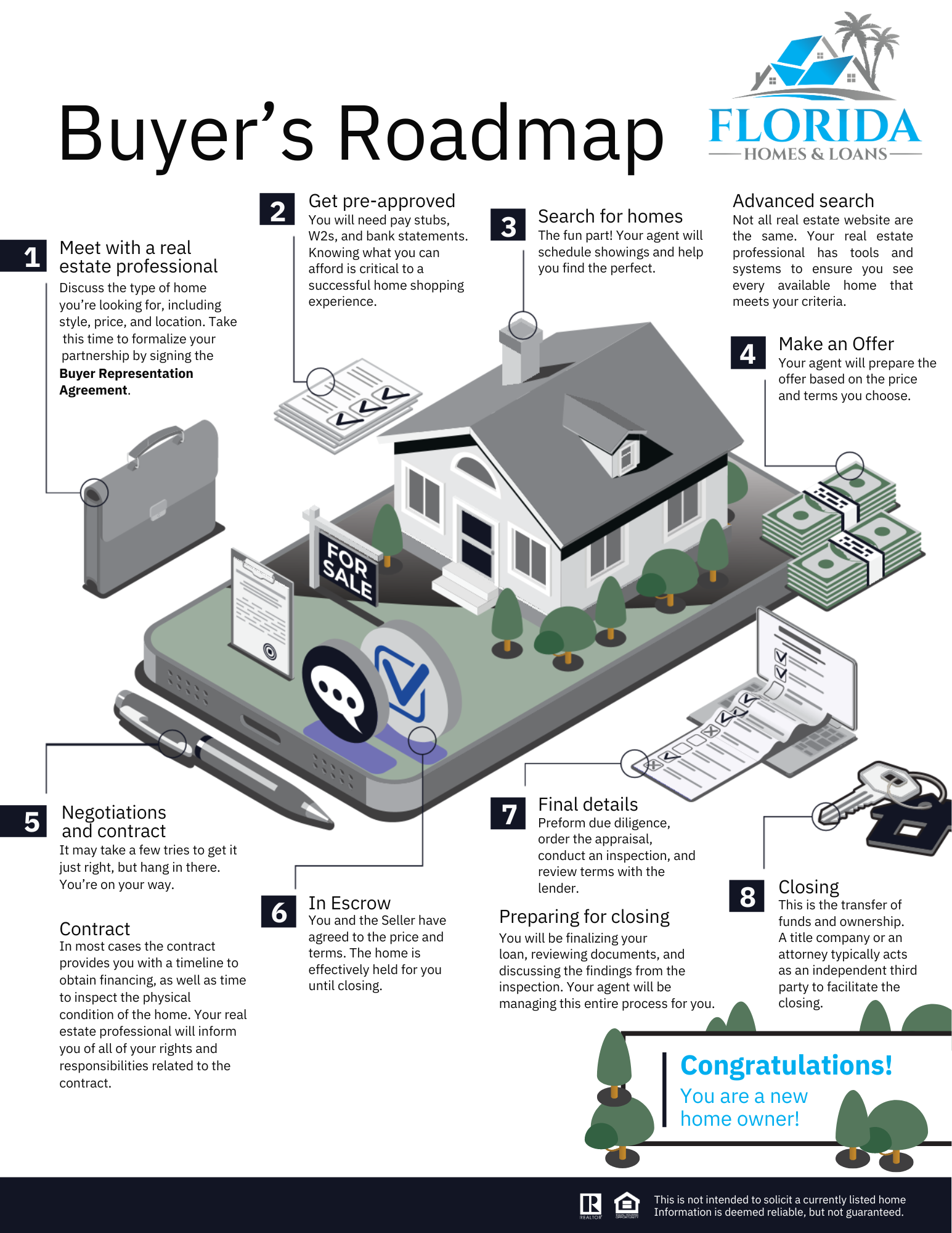

Steps of your home buying journey