Address

Buy a home

At Florida Homes & Loans Inc, we specialize in helping buyers just like you find the perfect property! Whether you're a first-time homebuyer or looking to upgrade, our expert team is here to guide you every step of the way.

Connect with our agents

Finance a home

Florida Homes & Loans can get you pre-approved so you're ready to make an offer quickly when you find the right home.

NMLS 2295908

Get Pre-Approved

Sell a home

No matter which approach you choose to sell your home, we're here to guide you toward a successful sale.

See your options

- Any

- $ 100,000

- $ 150,000

- $ 200,000

- $ 400,000

- $ 800,000

- Any

- $ 200,000

- $ 300,000

- $ 400,000

- $ 600,000

- $ 1,000,000

- Any

- 1

- 2

- 3

- 4

- 5

- Any

- 1

- 2

- 3

- 4

- 5

- Any

- 1

- 2

- 3

- 4

- 5

- Any

- 1

- 2

- 3

- 4

- 5

10,000+ Properties Available

- Default

- Baths (Most)

- Beds (Most)

- Newest Listings

- Square Feet (Biggest)

- Price-High To Low

- Price-Low To High

- 1/32 32

Open Sat 12PM-2PM

Open Sat 12PM-2PM$748,500

4 Beds2.5 Baths2,557 SqFt22660 SW 105th Ave, Miami, FL 33190

Single Family Home

Listed by Ford Homes LLC

- 1/41 41

Open Sat 11AM-2PM

Open Sat 11AM-2PM$335,000

2 Beds1 Bath1,010 SqFt595 SE Airoso BLVD, Port Saint Lucie, FL 34983

Single Family Home

Listed by Partnership Realty Inc.

Coming Soon

Coming Soon$520,000

3 Beds2 Baths1,415 SqFt532 SW Timber TRL, Stuart, FL 34997

Single Family Home

Listed by Keller Williams Realty Services

- 1/37 37

Coming Soon

Coming Soon$3,650,000

5 Beds5.1 Baths3,520 SqFt501 Eldorado LN, Delray Beach, FL 33444

Single Family Home

Listed by Douglas Elliman

- 1/54 54

Open Sat 11AM-2PM

Open Sat 11AM-2PM$889,000

5 Beds3 Baths3,129 SqFt13218 La Mirada CIR, Wellington, FL 33414

Single Family Home

Listed by Keller Williams Dedicated Prof

- 1/44 44

Open Sat 1PM-3PM

Open Sat 1PM-3PM$519,000

3 Beds2.1 Baths1,298 SqFt15 Laurel Oaks CIR, Tequesta, FL 33469

Townhouse

Listed by Compass Florida LLC

- 1/48 48

Coming Soon

Coming Soon$675,000

3 Beds3 Baths2,528 SqFt4721 N 129th AVE, West Palm Beach, FL 33411

Single Family Home

Listed by LPT Realty

- 1/39 39

Coming Soon

Coming Soon$750,000

4 Beds2.1 Baths2,499 SqFt1537 Verawood LN, Delray Beach, FL 33445

Single Family Home

Listed by Compass Florida LLC

- 1/64 64

Open Sat 1PM-3PM

Open Sat 1PM-3PM$375,000

2 Beds2 Baths1,357 SqFt26 Centennial Ct #26, Deerfield Beach, FL 33442

Townhouse

Listed by Madison Allied LLC

- 1/50 50

Open Fri 10AM-12PM

Open Fri 10AM-12PM$2,490,000

5 Beds6 Baths5,592 SqFt1942 MUIRFIELD WAY, Oldsmar, FL 34677

Single Family Home

Listed by PREMIER SOTHEBYS INTL REALTY

- 1/94 94

Open Sun 3AM-5:30PM

Open Sun 3AM-5:30PM$1,495,000

3 Beds2 Baths1,835 SqFt1390 GULF BLVD #1204, Clearwater, FL 33767

Condo

Listed by BEACH TO BAY BROKERS LLC

- 1/74 74

Open Sun 1PM-4PM

Open Sun 1PM-4PM$1,395,000

3 Beds5 Baths3,460 SqFt5818 TIDEWATER PRESERVE BLVD, Bradenton, FL 34208

Single Family Home

Listed by MICHAEL SAUNDERS & COMPANY

- 1/56 56

Open Sun 1PM-3PM

Open Sun 1PM-3PM$1,350,000

2 Beds3 Baths2,222 SqFt2413 S CAROLINA AVE, Tampa, FL 33629

Townhouse

Listed by COMPASS FLORIDA, LLC

- 1/54 54

Open Sat 11AM-2PM

Open Sat 11AM-2PM$1,298,000

4 Beds3 Baths3,908 SqFt19893 SAMBAR DEER LOOP, Lutz, FL 33559

Single Family Home

Listed by THE SOMERDAY GROUP PL

- 1/95 95

Open Sun 12AM-4PM

Open Sun 12AM-4PM$1,290,000

6 Beds5 Baths5,309 SqFt19270 BRIARBROOK DR, Tampa, FL 33647

Single Family Home

Listed by AGILE GROUP REALTY

- 1/100 100

Open Sun 11AM-4PM

Open Sun 11AM-4PM$1,250,000

5 Beds3 Baths3,694 SqFt327 WOOD ST, Lake Mary, FL 32746

Single Family Home

Listed by RE/MAX ASSURED

- 1/59 59

Open Sat 12PM-3PM

Open Sat 12PM-3PM$1,249,500

3 Beds2 Baths1,674 SqFt830 THE ESPLANADE N #203, Venice, FL 34285

Condo

Listed by ENGEL & VOELKERS VENICE DOWNTOWN

- 1/58 58

Open Thu 4PM-6PM

Open Thu 4PM-6PM$1,200,000

5 Beds3 Baths4,474 SqFt19206 ROBERTSON ST, Orlando, FL 32833

Single Family Home

Listed by EXP REALTY LLC

- 1/76 76

Open Sat 11AM-2PM

Open Sat 11AM-2PM$950,000

4 Beds3 Baths2,107 SqFt3819 W SAN MIGUEL ST, Tampa, FL 33629

Single Family Home

Listed by AGILE GROUP REALTY

- 1/58 58

Open Sun 1PM-3PM

Open Sun 1PM-3PM$949,000

2 Beds2 Baths1,973 SqFt624 S PINE ST, New Smyrna Beach, FL 32169

Single Family Home

Listed by EXIT REAL ESTATE PROPERTY SOL

- 1/57 57

Open Sat 11AM-2PM

Open Sat 11AM-2PM$929,000

3 Beds2 Baths2,092 SqFt119 LAKE DR, Oviedo, FL 32765

Single Family Home

Listed by PRATT REALTY INC

- 3D

Open Sat 12PM-2PM

Open Sat 12PM-2PM$925,000

3 Beds2 Baths2,149 SqFt2295 WATROUS DR, Dunedin, FL 34698

Single Family Home

Listed by KATIE DUCHARME REALTY, LLC

- 3D

Open Sun 1PM-4PM

Open Sun 1PM-4PM$914,900

3 Beds3 Baths2,335 SqFt10180 CANAVERAL CIR, Sarasota, FL 34241

Single Family Home

Listed by ENGEL + VOELKERS SARASOTA

- 3D

Open Sat 11AM-3PM

Open Sat 11AM-3PM$899,900

4 Beds3 Baths2,234 SqFt3666 S CENTRAL AVE, Flagler Beach, FL 32136

Single Family Home

Listed by FAIR MARKET REALTY

Read our blogs..

Renting vs. Buying: The Net Worth Gap You Need To See

Renting vs. Buying: The Net Worth Gap You Need To See

Renting vs. Buying: The Net Worth Gap You Need To See Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth. Every three years, the Federal Reserve Board shares a report called the Survey of Consumer Finances (SCF). It shows how much wealth homeowners and renters have – and the difference is significant. On average, a homeowner’s net worth is nearly 40 times higher than a renter’s. Check out the graph below to see the difference for yourself: Why Homeowner Wealth Is So High In the previous version of that report, the average homeowner’s net worth was about $255,000, while the average renter’s was just $6,300. That’s still a big gap. But in the most recent update, the spread got even bigger as homeowner wealth grew even more (see graph below): As the SCF report says: “. . . the 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.” One big reason why homeowner wealth shot up is home equity. Equity is the difference between your home’s value and what you owe on your mortgage. You gain equity by paying down your mortgage and when your home’s value goes up. Over the past few years, home prices have gone up a lot. That’s because there weren’t enough available homes for all the people who wanted one. This supply-demand imbalance pushed home prices up – and that translated into faster equity gains and even more net worth for homeowners. If you’re still torn between whether to rent or buy, here’s what you should know. While inventory has grown this year, in most places, there’s still not enough to go around. That’s why expert forecasts show prices are expected to go up again next year nationally. It’ll just be at a more moderate pace. While that’s not the sky-high appreciation we saw during the pandemic, it still means potential equity gains for you if you buy now. As Ksenia Potapov, Economist at First American, explains: “Despite the risk of volatility in the housing market, homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.” But prices and inventory are going to vary by area. So, lean on a local real estate agent. They’ll be able to give you the local trends and speak to the other financial and lifestyle benefits that come with owning a home. That crucial information will help you decide the best move for you right now. As Bankrate explains: “Deciding between renting and buying a home isn’t just about cost — the decision also involves long-term financial strategies and personal circumstances. If you’re on the fence about which is right for you, it may be helpful to speak with a local real estate agent who knows your market well. An experienced agent can help you weigh your options and make a more informed decision.” Bottom Line If you’re not sure if you should rent or buy, keep in mind that if you can make the numbers work, owning a home can really grow your wealth over time. And if homeownership feels out of reach, connect with a local real estate agent and lender. They can help you explore programs that may make buying possible. November 7, 2024/by KCM CREW

MORE

Redfin Reports The Number of Renter Households Is Growing Three Times Faster Than Homeowner Households

Redfin Reports The Number of Renter Households Is Growing Three Times Faster Than Homeowner Households

November 05, 2024 8:00 am EST San Jose, CA, Los Angeles and San Diego have the highest shares of renter households, while Cape Coral, FL, Charleston, SC and Columbia, SC have the lowest SEATTLE--(BUSINESS WIRE)-- (NASDAQ: RDFN) — The number of renter households rose 2.7%, in the third quarter year over year, to a record 45.6 million. That’s according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage. That rate of growth is three times faster than the 0.9% increase in homeowner households, which now total a record 86.9 million. The 2.7% increase—representing 1.18 million additional renter households—was the second fastest pace since 2015, only trailing the first quarter’s 2.8% rate. Renter households have formed faster than homeowner households for the past four quarters as the cost of buying a home rose faster than the cost of renting. The median asking rent was up 0.6% year over year in September, but rents have remained largely flat for the past two years—becoming more affordable as wages grew at around 4%. In contrast, home prices climbed 6% year over year in September and have grown more than 10% in the past two years. Highlighting the affordability barriers that exist for prospective homeowners, just 2.5% of U.S. homes changed hands in the first eight months of 2024—the lowest rate in decades. “Affordable housing has been at the forefront of this election cycle because so many people are struggling to see how they will ever become homeowners—especially those from younger generations,” said Redfin Senior Economist Sheharyar Bokhari. “With home prices at record highs and mortgage rates remaining elevated, renting is increasingly the only viable choice for many young people and families. Building more homes will help address that, but we also have to recognize that Gen Z and future generations may not view homeownership as a life goal and the rentership rate may continue to rise for years to come.” New multifamily units are being completed at a record pace Part of the reason rents have remained stable—and renting has become more attractive to many—is the boom in multifamily construction over the past two years. The country is adding new multifamily housing units at an annual rate of 647,000 (as of the third quarter)—the fastest pace in records dating back to 1994. The recent boom in multifamily construction helped meet surging demand in some areas—especially in Sun Belt states—but builders are now pumping the brakes. Permits to build multifamily housing units were down 16% year over year in September, and down 47% from the post-pandemic high in February 2023—which was the highest mark in nearly 40 years. More than half the households in San Jose and Los Angeles rent Nationwide, just over one-third (34.4%) of households in the U.S. are renter households—a figure that has remained the same for the past three quarters. The rentership share is highest in metros in California and in New York City, where homes are generally more expensive to buy. San Jose, CA has a rentership rate of 52%, the highest among the 75 largest U.S. metropolitan areas. It’s followed by Los Angeles (50.8%), New York (49.1%), San Diego (48%) and Fresno, CA (47.4%). Rentership rates are lower in metros where, historically, it’s been more affordable to buy a home. In Cape Coral, FL, 21.8% of households are renter households—the lowest share among the metros Redfin analyzed. It’s followed by Charleston, SC (23.7%), Columbia, SC (24.5%), Allentown, PA (27.2%) and Detroit (28.2%). To view the full report, including charts, methodology and additional metro level data, please visit: https://www.redfin.com/news/renter-household-growth-q3-2024 About Redfin Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, rentals, lending, title insurance, and renovations services. We run the country's #1 real estate brokerage site. Our customers can save thousands in fees while working with a top agent. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can have our renovations crew fix it up to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1.6 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 4,000 people. Redfin’s subsidiaries and affiliated brands include: Bay Equity Home Loans®, Rent.™, Apartment Guide®, Title Forward® and WalkScore®. For more information or to contact a local Redfin real estate agent, visit www.redfin.com. To learn about housing market trends and download data, visit the Redfin Data Center. To be added to Redfin's press release distribution list, email press@redfin.com. To view Redfin's press center, click here. View source version on businesswire.com: https://www.businesswire.com/news/home/20241105783328/en/ Contact RedfinRedfin Journalist Services:Kenneth Applewhaitepress@redfin.com Source: Redfin Released November 5, 2024 https://investors.redfin.com/news-events/press-releases/detail/1209/redfin-reports-the-number-of-renter-households-is-growing?distinct_id=hYtR6AyJa&user_email=gemma%40flhomeandloan.com

MORE

What To Look For From This Week’s Fed Meeting

What To Look For From This Week’s Fed Meeting

What To Look For From This Week’s Fed Meeting You may be hearing a lot of talk about the Federal Reserve (the Fed) and how their actions will impact the housing market right now. Here’s why. The Fed meets again this week to decide the next step with the Federal Funds Rate. That’s how much it costs banks to borrow from each other. Now, that’s not the same thing as setting mortgage rates, but mortgage rates can be influenced through this process. And if you’re thinking about buying or selling a home, you may be wondering about the downstream impact and when mortgage rates will come down. Here’s a quick rundown of what you need to know to help you anticipate what’ll happen next. The Fed’s decisions are guided by these three key economic indicators: The Direction of Inflation How Many Jobs the Economy Is Adding The Unemployment Rate Let’s take a look at each one. 1. The Direction of Inflation You’ve likely noticed prices for everyday goods and services seem to be higher each time you make a purchase at the store. That’s because of inflation – and the Fed wants to see that number come back down so it’s closer to their 2% target. Right now, it’s still higher than that. But despite a little volatility, inflation has generally been moving in the right direction. It gradually came down over the past two years, and is holding fairly steady right now (see graph below): The path of inflation – though still not at their target rate – is a big part of the reason why the Fed will likely lower the Fed Funds Rate again this week to make borrowing less expensive, while still ensuring the economy continues to grow. 2. How Many Jobs the Economy Is Adding The Fed is also keeping an eye on how many new jobs are added to the economy each month. They want job growth to slow down a bit before they cut the Federal Funds Rate further. When fewer jobs are created, it shows the economy is still doing well, but gradually cooling off—exactly what they’re aiming for. And that’s what’s happening right now. Reuters says: “Any doubts the Federal Reserve will go ahead with an interest-rate cut . . . fell away on Friday after a government report showed U.S. employers added fewer workers in October than in any month since December 2020.” Employers are still hiring, but just not as many positions right now. This shows the job market is starting to slow down after running hot for a while, which is what the Fed wants to see. 3. The Unemployment Rate The unemployment rate shows the percentage of people who want jobs but can’t find them. A low unemployment rate means most people are working, which is great. However, it can push inflation higher because more people working means more spending—and that makes prices go up. Many economists consider any unemployment rate below 5% to be as close to full employment as is realistically possible. In the most recent report, unemployment is sitting at 4.1% (see graph below): Unemployment this low shows the labor market is still strong even as fewer jobs were added to the economy. That’s the balance the Fed is looking for. What Does This Mean Going Forward? Overall, the economy is headed in the direction the Fed wants to see – and that’s why experts say they will likely cut the Federal Funds Rate by a quarter of a percentage point this week, according to the CME FedWatch Tool. If that expectation ends up being correct, that could pave the way for mortgage rates to come down too. But that doesn’t mean they’ll fall immediately. It will take some time. Remember, the Fed doesn’t determine mortgage rates. Forecasts show mortgage rates will ease more gradually over the course of the next year as long as these economic indicators continue to move in the right direction and the Fed can continue their Federal Funds rate cuts through 2025. But a change in any one of the factors mentioned here could cause a shift in the market and in the Fed’s actions in the days and months ahead. So, brace for some volatility, and for mortgage rates to respond along the way. As Ralph McLaughlin, Senior Economist at Realtor.com, notes: “The trajectory of rates over the coming months will be largely dependent on three key factors: (1) the performance of the labor market, (2) the outcome of the presidential election, and (3) any possible reemergence of inflationary pressure. While volatility has been the theme of mortgage rates over the past several months, we expect stability to reemerge towards the end of November and into early December.” Bottom Line While the Fed’s actions play a part, economic data and market conditions are what really drive mortgage rates. As we move through the rest of 2024 and 2025, expect rates to stabilize or decline gradually, offering more certainty in what has been a volatile market.

MORE

9 Buyer, Seller Trends Driving Home Sales

9 Buyer, Seller Trends Driving Home Sales

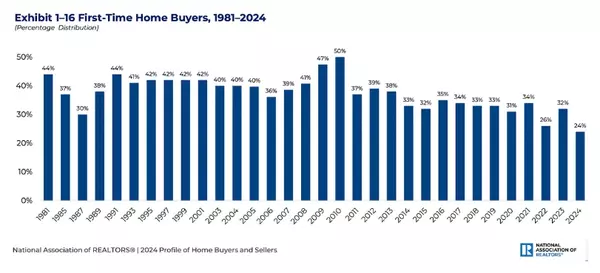

NAR’s 2024 Profile of Home Buyers and Sellers offers a mixed picture of who’s succeeding and struggling in the housing market. It hasn’t been easy to be a home buyer over the past year, particularly for first timers who’ve faced elevated home prices, higher mortgage rates and slim inventory options. (Although, inventory has been improving lately). Home sellers, on the other hand, have had an easier time, continuing to leverage record equity to purchase their next home—often in cash. “The U.S. housing market is split into two groups: first-time buyers struggling to enter the market and current homeowners buying with cash,” says Jessica Lautz, deputy chief economist and vice president of research at the National Association of REALTORS®. “First-time buyers face high home prices, high mortgage interest rates and limited inventory, making them a decade older with significantly higher incomes than previous generations of buyers. Meanwhile, current homeowners can more easily make housing trades using built-up housing equity for cash purchases or large down payments on dream homes.” Here are a few takeaways from the NAR’s newly released 2024 Profile of Home Buyers and Sellers, a consumer survey that reflects completed transactions between July 2023 and June 2024. First-time buyers are retreating from the market. The share of first-time buyers has fallen to a historic low of 24%, according to NAR. Prior to 2008, first-time buyers comprised 40% of the market. First-time buyers, who do not have proceeds from another home sale to leverage, are finding it takes a lot more money to enter today’s housing market. Nearly half say high rent is hampering their ability to save for a down payment, followed by student loans and credit card debt. Those who can afford homeownership tend to be older than in the past: The median age of first-time buyers this year reached an all-time high of 38 years old (compared to those in their late 20s in the 1980s). They’re also coming up with higher down payments than in years past—a median of 9% (the highest recorded since 1997). What’s more, first-time buyers are increasingly relying on others to help them buy: 25% used a gift or loan from a relative or friend for their home purchase. Cash buyers have surged to a record high. More than a quarter—26%—of home buyers over the past year paid cash for their home purchase—an all-time high, according to NAR’s data. This enables these buyers to bypass a mortgage at a time when interest rates on loans rose above 7% a year ago. Thirty-one percent of repeat home buyers were able to pay cash for their home purchase. “This is likely due to the increase in housing equity,” NAR’s report notes. Home sellers aim high—and it pays off. Sellers over the past year typically sold their property at 100% of their asking price—the highest recorded list-to-sale median since 2002, NAR notes. About 27% of sellers were even able to nab more than their list price. Home sellers also tended to sell their homes quickly, typically within three weeks. Due to high buyer demand and lack of housing inventory, 76% of home sellers didn’t offer a sales incentive; only 24% of sellers offered one (like covering the buyer’s closing costs or offering a home warranty policy), dropping from 33% the year prior. Multigenerational living gains traction. Multigenerational buyers climbed to an all-time high of 17% over the past year (up from 14% the previous year). Home buyers cited cost savings, elder care and accommodating young adults moving back home as reasons for purchasing a multigenerational home. “As home buyers encounter an unaffordable housing market, many are choosing to double up as families,” Lautz says. “Cost savings are a major factor, with young adults returning home—or never leaving—due to prohibitive rental and home prices. Meanwhile, elderly parents and relatives are moving in with family members as home buyers reprioritize what matters most to them.” FSBOs drop to an all-time low. For sale by owners comprised just 6% of home sales, a record low, according to NAR. Meanwhile, 90% of home sellers sold their home with the assistance of a real estate agent, citing benefits like being able to market their home to a wider pool of buyers and pricing the home more competitively. FSBOs typically sold their home for less—a median of $380,000 versus $435,000 for agent-assisted sold homes. “Most home buyers and sellers find it valuable to use an agent who is a REALTOR® to help them maneuver through the complicated home buying and selling processes, especially in a challenging housing market,” says NAR President Kevin Sears. Buyers dig deeper for higher down payments. In 2024, the median down payment among all buyers was 18%, the highest figure in more than 20 years. Broken out, first-time buyers made a median 9% down payment (their highest percentage since 1997), and repeat buyers’ down payments typically were 23% (their highest since 2003). Single women remain active in the housing market. Households with a single income and no kids—known as SINK buyers—have emerged as a homebuying force. Many SINKs are single females, who made up 20% of home sales over the past year while the share of single males fell to 8%. Meanwhile, the number of home buyers with children under the age of 18 is shrinking: 73% of recent home buyers did not have a child under the age of 18 in their home, the highest share on record, according to NAR’s data. Newly built homes gain greater buyer attention. New home purchases accounted for 15% of home sales over the past year, the highest share in about 17 years. New-home buyers say they were drawn to new construction because they wanted to avoid renovations or problems with systems, like plumbing or electricity, and they wanted to customize their home’s design features. Real estate agents remain a top information source. While buyers turned to the internet to help guide their home search, they rated real estate agents as the most useful information source. Eighty-six percent of buyers and 90% of sellers used a real estate agent in their transaction. The NAR consumer survey reveals the top qualities that sellers and buyers say they were looking for from an agent during the sales process. What Sellers Want Marketing the home to buyers: 22% Pricing the home competitively: 20% Selling the home within their specific timeframe: 18% Identifying ways to increase resale price: 15% Finding a buyer for the home: 13% What Buyers Want Point out unnoticed features/faults with a property: 55% Help to understand the process: 53% Negotiate better sales contract terms: 44% Provide a list of service providers (e.g. home inspector): 43% Improve knowledge of home search areas: 41% Melissa Dittmann Tracey Melissa Dittmann Tracey is a contributing editor for REALTOR® Magazine and editor of the Styled, Staged & Sold blog. Content by Melissa Dittmann Tracey https://www.nar.realtor/magazine/real-estate-news/9-buyer-seller-trends-driving-home-sales?distinct_id=hYtR6AyJa&user_email=gemma%40flhomeandloan.com

MORE

Is a Fixer Upper Right for You?

Is a Fixer Upper Right for You?

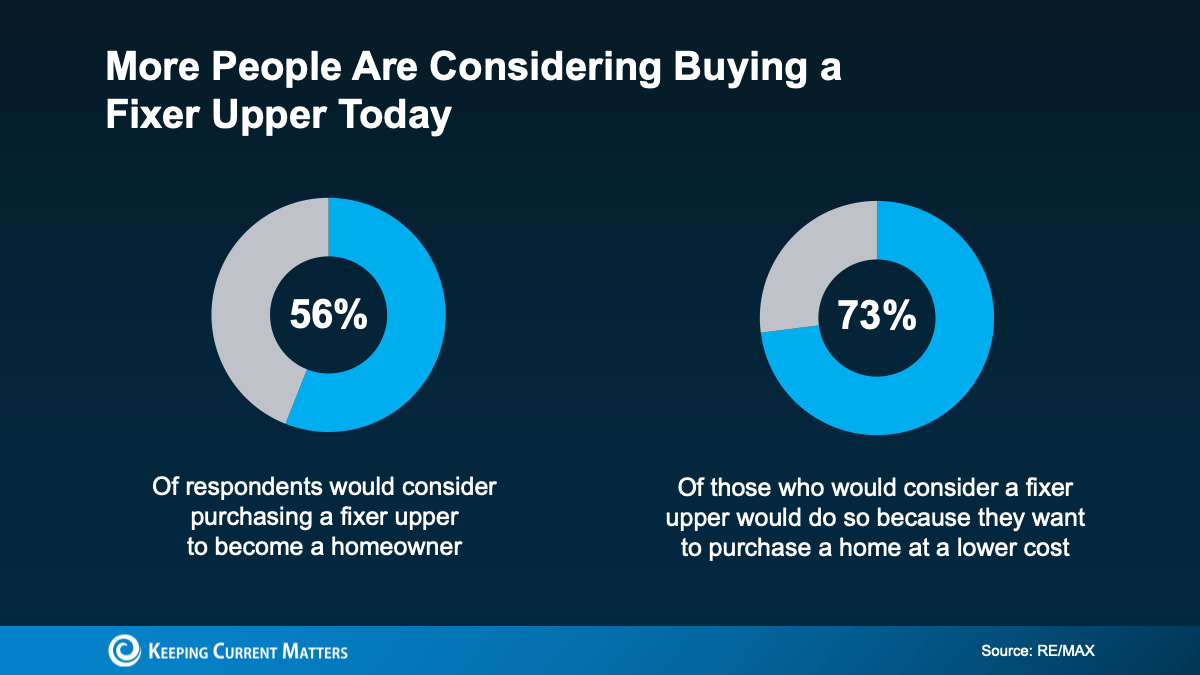

Looking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when affordability seems like a huge roadblock – and it might be with a fixer upper. Let’s dive into why buying a fixer upper could be your ticket to homeownership and how you can make it work. What Is a Fixer Upper? A fixer upper is a home that’s in livable condition but needs some work. The amount of work varies by home – some may need cosmetic updates like wallpaper removal and new flooring, while others might require more extensive repairs like replacing a roof or updating plumbing. Because they need some elbow grease, these homes typically have a lower price point, based on local market value. In fact, a survey from StorageCafe explains that fixer uppers generally cost about 29% less than move-in-ready homes. And that’s why, according to a recent survey, more buyers are considering homes that need a little extra work right now (see below): If you’re looking for an option to get your foot in the door, and you’re willing to roll up your sleeves and do a bit of work, a house with untapped potential may be a good option. Tips for Buying a Home That Needs Some Work Before you buy a home that may need a makeover, here are a few things to keep in mind: Choose a Good Location: You can repair a house, but you can’t change where it is. Make sure the home is in a neighborhood you like or one with increasing property values and a growing number of local amenities. This way, even after you spend money fixing it up, the house will be worth more later. Budget for Surprises: Fixing up a house can take more time and money than you might think. Make sure you save room in your budget for unexpected repairs or other unknowns that might come up while you’re working on the house. Get a Home Inspection: Before you buy, hire an inspector to check out the house. They’ll help you determine the necessary repairs, so you don’t end up with expensive surprises later. Plan Your Priorities: When deciding what to tackle first, it helps to categorize your goals. Think of your home in three ways: the must-haves (essential repairs), the nice-to-haves (upgrades that would make life easier), and the dream-state features (luxuries you can add later). This will help you prioritize and stick to your budget. Remember, the perfect home is the one you perfect after buying it. By starting with a fixer upper, you have the opportunity to customize a home to your liking while saving money on the initial purchase price. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home. Real estate agents are great at finding homes with potential. They know the local market and can guide you to homes where smart upgrades can add value. With their help, you’re more likely to find a house that fits your total budget and has room for worthwhile improvements. Bottom Line In today’s market, where the cost of homeownership can be intimidating, finding a move-in-ready home that fits your budget can feel like a real challenge. But if you’re open to putting in a little work, you can transform a fixer upper into your ideal home over time. A local real estate agent can help you explore what’s possible and find a place that’ll work for you.

MORE

What the Fed's Rate Cut Means for Mortgages

What the Fed's Rate Cut Means for Mortgages

in First Time Home Buyers, Mortgage News What the Fed's Rate Cut Means for Mortgages When the Federal Reserve cuts rates, many assume that mortgage rates will follow suit. But if you’re in the market for a home, you might have noticed that mortgage rates have not immediately decreased, leaving you wondering why. The Fed’s rate cut decision does not directly control mortgage rates. Instead, it influences other economic conditions, which could impact the mortgage market. In this article, we’ll look at the relationship between the federal funds rate and mortgage rates and the potential outlook for both. Why Did The Fed Cut The Base Rate? In September, the Federal Reserve noted that economic activity has continued to expand at a solid pace. “The U.S. economy is in a good place,” Fed Chair Jerome Powell said, “and our decision today is designed to keep it there.” Due to positive progress in the economy, the Fed cut the federal funds rate by .5%, or 50 basis points. The main factors that played a role in this decision where: Low unemployment: The unemployment rate is still below the national average, indicating a strong labor market. Inflation nearing target rate: Inflation is approaching the Fed’s goal of around 2% while maintaining economic stability. These improvements gave the Fed confidence to lower rates, making borrowing money cheaper and helping to stimulate further economic growth. How Does The Fed’s Rate Cut Impact Mortgage Rates? While the Federal Reserve’s decision to cut the benchmark interest rate can impact mortgage rates, the relationship is not always direct or immediate. The benchmark rate influences the overall borrowing environment, economic outlook and investor response, which can lead to changes in mortgage rates. Although mortgage rates did not immediately decrease following the Fed’s rate cut in September, they had already fallen by about half a percentage point in July and August in anticipation of the Fed’s action. The effect of a Fed rate cut varies depending on the type of mortgage: Fixed-rate mortgages are less directly affected by Fed rate cuts but may decline over time. Adjustable-rate mortgages (ARMs) are more directly affected, as they are often tied to short-term rates that closely follow the federal funds rate. A Fed rate cut can also have broader influence on the housing market, including: Increased Buyer Demand: Lower rates can boost homebuyer interest and lead to more competition and higher home prices. Increased Refinancing Opportunities: Current homeowners can refinance to lower rates. Increased Buying Power: Lower rates help borrowers to qualify for larger loans. When Is The Next Fed Rate Cut? According to most economists, the Fed is expected to cut rates two more times before the end of the year, with one meeting in November and another in December. These rate cuts are predicted to be around 0.25% to 0.5%. Jerome Powell has indicated that we could see more rounds of rate cuts continuing into 2025. However, while the Fed may keep lowering the base rate, mortgage rates won’t necessarily follow a straight downward trajectory. In fact, most economists predict that mortgage rates will remain volatile in the coming months, fluctuating up and down before ultimately trending lower over the next 6-18 months. Should You Wait For Lower Mortgage Rates? The idea of lower mortgage rates may be tempting, but waiting may not always be a great strategy. Lower rates can improve affordability, but while rates may decrease, home prices may rise, which could offset the savings. Rates can change quickly in a volatile market. If you find a good rate, it could be better to lock it in rather than waiting for further rate cuts. You may also find some peace of mind with a rate float down, which lets you benefit from a lower interest rate if rates drop while you’re locked in. Mortgage rates are influenced by a variety of factors, and timing the market can be tricky. Reach out to one of our licensed Mortgage Loan Originators to discuss your unique situation and get prepared to seize the opportunity that’s right for you.

MORE

Why are our rates so low?

1. WE SHOP RATES FOR EVERY LOAN: We compare rates from 198 lenders in real-time for you.

2. WE NEGOTIATE FOR YOU: Because we have closed so many loans, we can negotiate and obtain ridiculously low rates from lenders.

3. WE LOWER OUR PROFIT: Our profit per loan is much lower than that of our competitors. We aim to earn your business and your referrals.

By registering you agree to our Terms of Service & Privacy Policy. Consent is not a condition of buying a property, goods, or services.

Why Choose Us

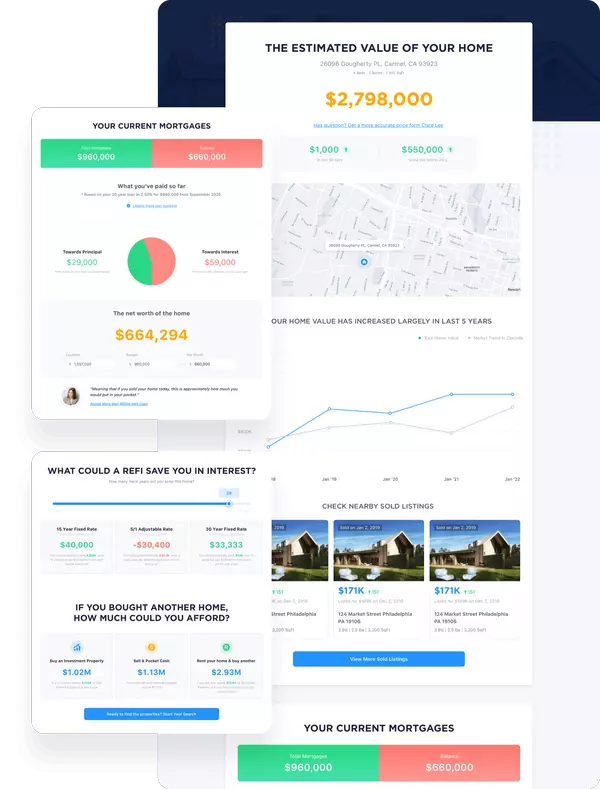

Free & Instant Home Valuation

Estimate how much you can get by selling your home and keep track as the market changes.

Sell Faster

Our team utilizes the power of online marketing to sell faster than an average real estate agent.

Save Money

Our experts help you sell for the highest price point possible.