The Benefits of Using Your Equity To Make a Bigger Down Payment

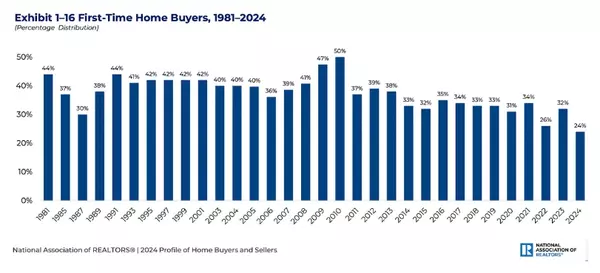

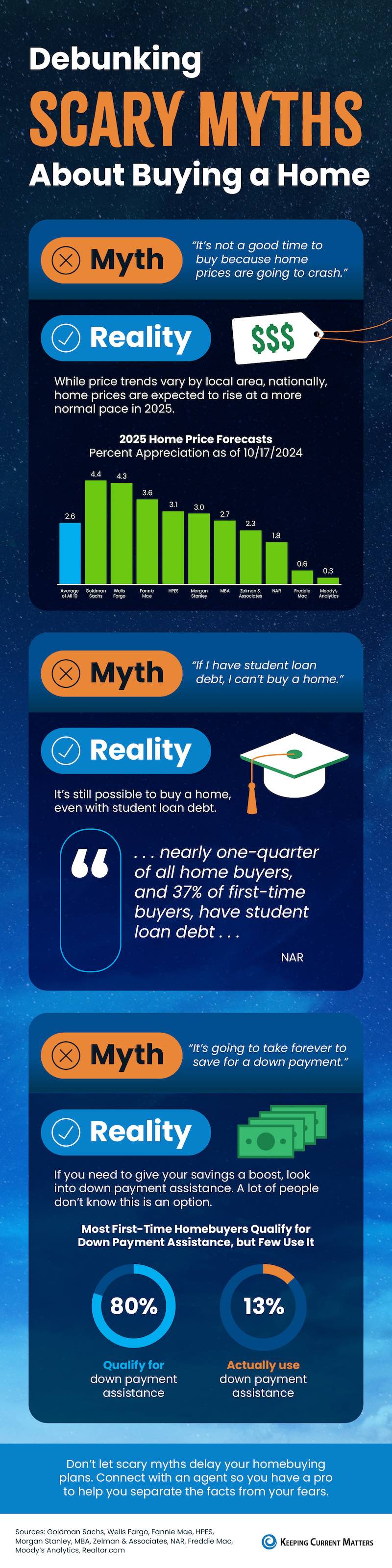

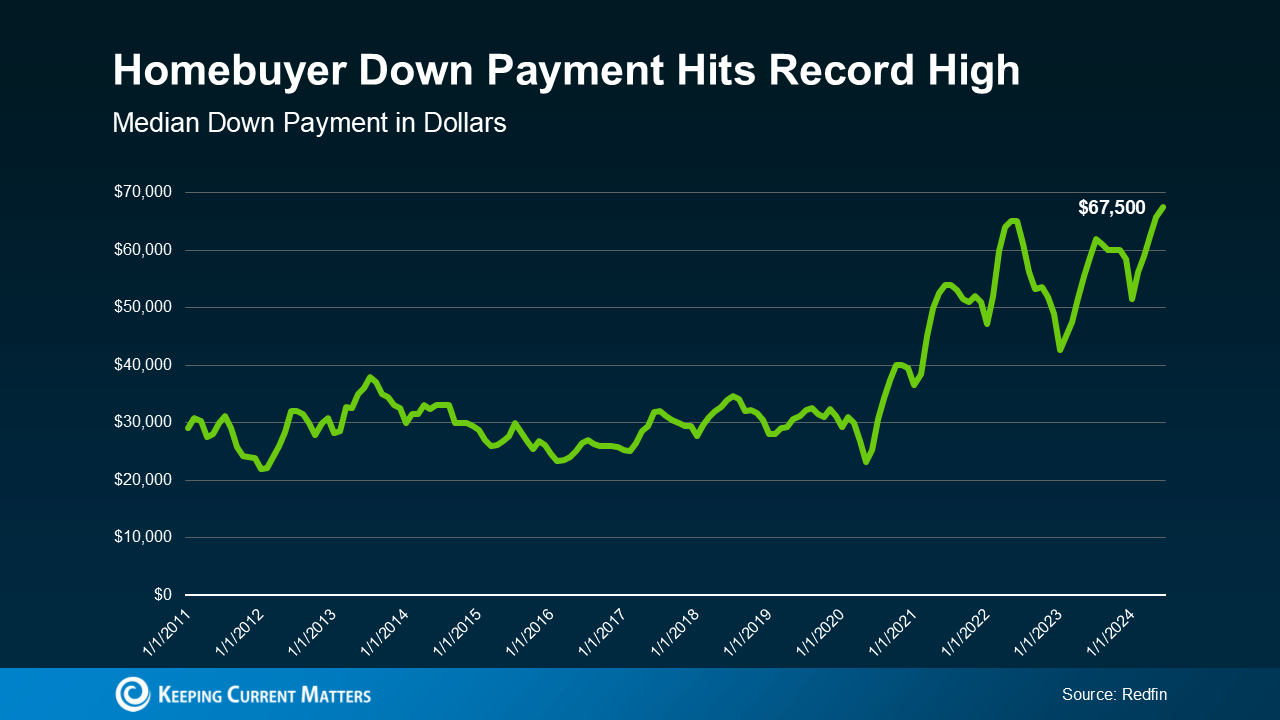

Did you know? Homeowners are often able to put more money down when they buy their next home. That’s because, once they sell, they can use the equity they have in their current house toward their next down payment. And it’s why as home equity reaches a new height, the median down payment has too. According to the latest data from Redfin, the typical down payment for U.S. homebuyers is $67,500—that’s nearly 15% more than last year, and the highest on record (see graph below): Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a larger down payment on your new home. That’s a major opportunity, especially if you’ve had concerns about affordability. Now, it’s important to remember you don’t have to make a big down payment to buy your next home—there are loan programs that let you put as little as 3%, or even 0% down. But there’s a reason so many current homeowners are opting to put more money down. That’s because it comes with some serious perks. Why a Bigger Down Payment Can Be a Game Changer 1. You’ll Borrow Less and Save More in the Long Run When you use your equity to make a bigger down payment on your next home, you won’t have to borrow as much. And the less you borrow, the less you’ll pay in interest over the life of your loan. That’s money saved in your pocket for years to come. 2. You Could Get a Lower Mortgage Rate Providing a larger down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage rate they’ll likely be willing to give you. And that amplifies your savings. 3. Your Monthly Payments Could Be Lower A bigger down payment doesn’t just help you reduce how much you have to borrow—it also means your monthly mortgage payment may be smaller. That can make your next home more affordable and give you a bit more breathing room in your budget. 4. You Can Skip Private Mortgage Insurance (PMI) If you can put down 20% or more, you can avoid Private Mortgage Insurance (PMI), which is an added cost many buyers have to pay if their down payment isn’t as large. Freddie Mac explains it like this: “For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner’s insurance. It’s a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%.” Avoiding PMI means you’ll have one less expense to worry about each month, which is a nice bonus. Bottom Line Down payments are at a record high, largely because recent equity gains are putting homeowners in a position to put more money down.

Newsletter - 10/15/2024

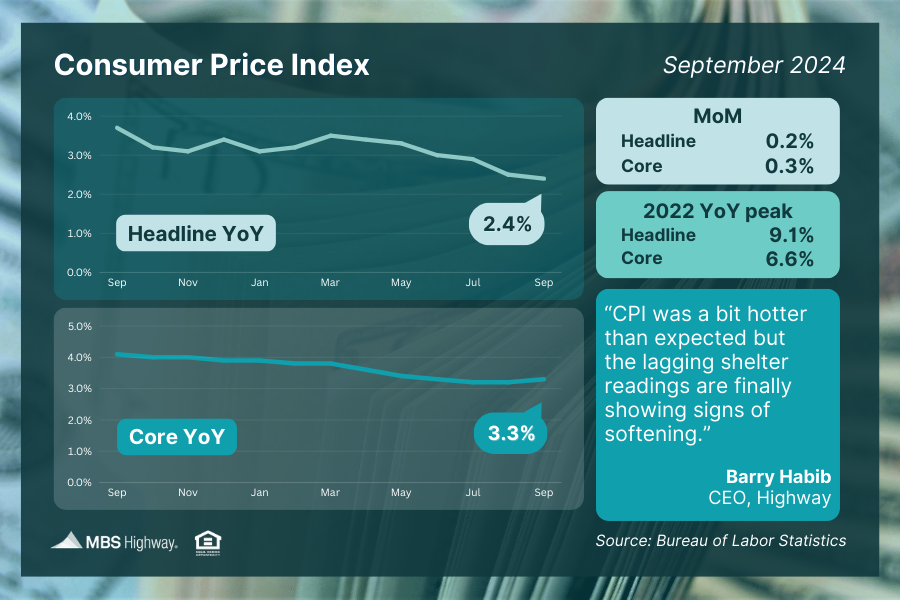

Week of October 7, 2024 in Review Inflation was hotter than expected in September, but there is important context to those headlines. Plus, another index showed rising home prices. Read on for these stories and more: -Softening Shelter Crucial to Consumer Inflation -Annual Wholesale Inflation Hotter Than Expected -Initial Jobless Claims at 14-Month High -Annual Home Price Growth Continues Softening Shelter Crucial to Consumer Inflation The latest Consumer Price Index (CPI) showed more progress on headline inflation, as consumer prices rose 2.4% for the 12 months ending in September. While this was hotter than expected, it does mark a slowing from August’s 2.5% annual gain and the lowest reading since February 2021. The core measure, which strips out volatile food and energy prices, increased 0.3% from August, coming in above estimates. The annual reading ticked higher from 3.2% to 3.3%. Transportation costs, including airline fares and motor vehicle insurance, were key reasons for the pricing pressure that was seen last month. The monthly reading for shelter was encouraging, as it showed signs of softening. What’s the bottom line? We are seeing progress in consumer inflation, albeit slowly. For example, if we annualize the last three months of readings, the year-over-year rate of inflation would be lower, coming in at 2.1% for Headline CPI and 3% for Core CPI. Plus, September’s low shelter reading is an important development as it may be the first sign that the shelter component in CPI is finally catching up to market rents. Given that the shelter component makes up nearly 46% of Core CPI, lower shelter readings will make it much easier for inflation to make progress towards the Fed’s 2% target over time. The Fed also acknowledged ahead of the report that they were expecting shelter readings to moderate. Annual Wholesale Inflation Hotter Than Expected The Producer Price Index (PPI), which measures inflation on the wholesale level, was unchanged in September, with the annual reading falling from an upwardly revised 1.9% to 1.8%. Core PPI, which strips out volatile food and energy prices, rose 0.2% for the month and the year-over-year reading moved higher to 2.8%. What’s the bottom line? While the hotter than expected CPI and PPI readings have caused some fear that inflation is reemerging, we need to look at the numbers in context. September’s 1.8% year-over-year PPI reading is well below the peak of 11.7% seen in 2022. Inflation has made significant progress lower and it’s important to remember that it will not move down in a straight line. Initial Jobless Claims at 14-Month High Initial Jobless Claims were higher than expected in the latest week, rising by 33,000 for a total of 258,000 people filing for unemployment benefits for the first time. Continuing Claims also surged higher by 42,000, as 1.861 million people are still receiving benefits after filing their initial claim. What’s the bottom line? Initial Jobless Claims tied a high last seen in August 2023, though the spike higher was due in part to elevated filings in states impacted by Hurricane Helene. Hurricane Milton could cause additional elevated filings in the coming weeks. Meanwhile, Continuing Claims have topped 1.8 million since the start of June, remaining near three-year highs. This data continues to suggest that employers have slowed down their pace of hiring, making it harder for some people to find new employment once they are let go. Annual Home Price Growth Continues ICE (formerly known as Black Knight) reported that national home values rose 0.12% in August after seasonal adjustments, with their index showing that prices are 3% higher than a year ago, down from 3.6% in the previous report. What’s the bottom line? ICE is not alone in their findings, as home price gains continue to be reported in other major indexes as well. For instance, Case-Shiller’s latest report (considered the gold standard in tracking changes in residential real estate values) showed that national home values hit another record high in July, with prices 5% higher than a year earlier. The Federal Housing Finance Agency also reported 4.5% annual growth over that same period. These reports show that homeownership continues to be a great investment for wealth creation. Family Hack of the Week National Chocolate Cupcake Day is October 18, but this recipe courtesy of the Food Network is worth enjoying every day of the year. Yields 12 cupcakes. Preheat oven to 325 degrees Fahrenheit. Line a muffin pan with paper liners. Cream 1/4 pound unsalted butter (room temperature) and 1 cup sugar until light and fluffy. Add 4 extra-large eggs, 1 at a time. Mix in 1 1/3 cups chocolate syrup and 1 tablespoon pure vanilla extract. Add 1 cup all-purpose flour and 1 teaspoon instant coffee granules and mix until just combined. Do not overmix! Scoop batter into muffin cups and bake for 30 minutes or until just set in the middle. Cool thoroughly in the pan before removing. To make the ganache icing, cook 1/2 cup heavy cream, 8 ounces semisweet chocolate chips, and 1/2 teaspoon coffee granules in the top of a double boiler over simmering water until smooth and warm. Dip the tops of the cupcakes into the ganache. Do not refrigerate. What to Look for This Week Thursday brings several important reports, including an update on September’s Retail Sales, weekly Jobless Claims and homebuilder confidence for this month. More housing news follows on Friday with September’s Housing Starts and Building Permits data. Technical Picture Mortgage Bonds traded in a sideways pattern the last few days, ending last week just above nearby support at 100.18 as they look like they are trying to form a base and find their footing. The 10-year broke above its 100-day Moving Average and ended last week trading in a narrow range with the 100-day Moving Average acting as a floor and a ceiling of resistance at the 4.126% Fibonacci level.

Octobers Real Estate and Mortgage news for Florida

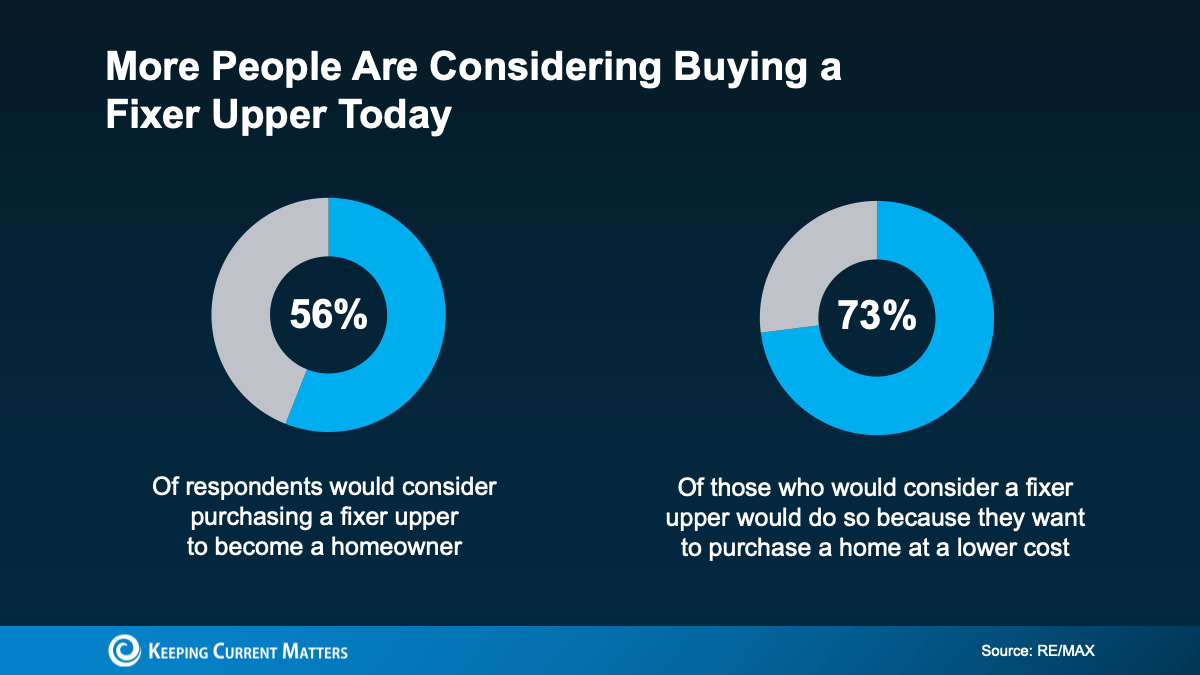

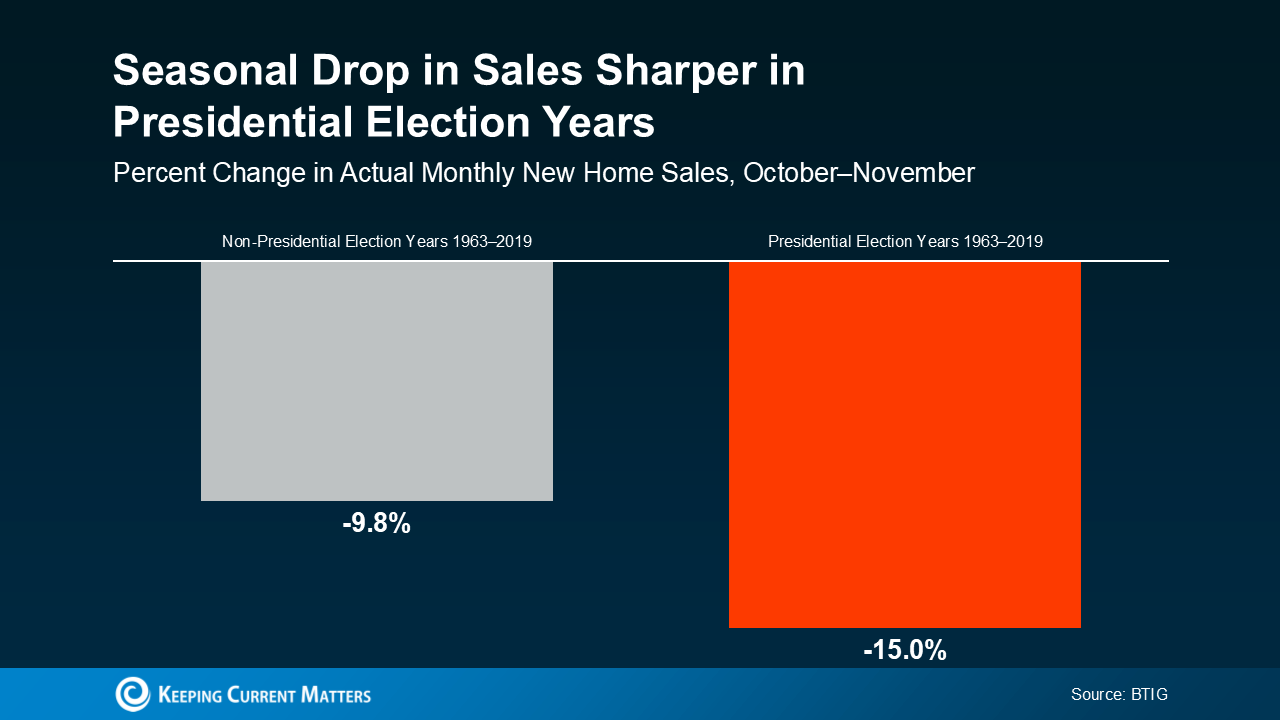

As we step into October, Florida's real estate market continues to be a focal point for both buyers and sellers. This month brings a mix of exciting developments and some challenges, especially in the mortgage sector. Here's a comprehensive update on what you need to know. **Market Update** Florida's real estate market has shown remarkable resilience over the past few months. Despite concerns about rising interest rates and economic uncertainties, the state continues to attract homebuyers from across the country. The allure of Florida's sunny climate, no state income tax, and diverse lifestyle options keeps demand high. In particular, metropolitan areas like Miami, Orlando, and Tampa are experiencing significant activity. According to recent data, median home prices in these cities have seen a year-over-year increase of approximately 8-10%. Inventory levels remain tight, with homes spending an average of just 30 days on the market before being snapped up. However, it's not all smooth sailing. The higher interest rates have put some pressure on affordability. First-time homebuyers are finding it increasingly challenging to enter the market, leading to a slight cooling in sales volume compared to last year. Nonetheless, seasoned investors and cash buyers continue to drive transactions. **Real Estate News** October has brought several noteworthy developments in Florida's real estate landscape: 1. **New Construction Boom:** Developers are capitalizing on the high demand by launching new residential projects across the state. From luxury condos in Miami to suburban single-family homes in Central Florida, new construction is booming. This influx of new properties could help alleviate some of the inventory shortages that have plagued the market. 2. **Tech Integration:** The adoption of technology in real estate transactions is accelerating. Virtual tours, digital closings, and AI-driven property recommendations are becoming standard practices. These innovations make it easier for out-of-state buyers to explore Florida properties without physically being present. 3. **Sustainability Focus:** There's a growing emphasis on sustainability within Florida's real estate sector. Developers are incorporating green building practices and energy-efficient features into new projects. Homebuyers are increasingly prioritizing eco-friendly homes that reduce their carbon footprint and utility bills. 4. **Policy Changes:** Recent policy changes at both state and federal levels are impacting the market dynamics. For instance, updates to zoning laws aim to streamline the approval process for new developments, potentially speeding up construction timelines. 5. **Investment Opportunities:** Florida remains a hotspot for real estate investors. Short-term rental properties near tourist attractions continue to yield impressive returns. Additionally, commercial real estate in bustling urban centers is attracting substantial interest from institutional investors. **Mortgage News** The mortgage landscape is undergoing significant shifts this October: 1. **Interest Rates:** Mortgage rates have been on an upward trajectory throughout 2023 due to inflationary pressures and Federal Reserve policies. As of October, the average 30-year fixed mortgage rate hovers around 6-7%. While this is higher than last year's historic lows, it's still relatively affordable compared to long-term averages. 2. **Loan Programs:** To combat affordability challenges, lenders are introducing innovative loan programs tailored for first-time buyers and low-to-moderate income households. These programs often feature lower down payment requirements and more flexible credit criteria. 3. **Refinancing Slowdown:** With rising rates, refinancing activity has slowed considerably compared to the previous years' boom when homeowners rushed to lock in lower rates. 4. **Regulatory Changes:** New regulations aimed at increasing transparency in lending practices are coming into effect this month. Borrowers can expect clearer disclosures regarding fees and terms associated with their mortgages. In summary, October brings a blend of opportunities and hurdles for Florida's real estate market. Whether you're looking to buy your dream home or invest in lucrative properties, staying informed about these trends will help you make savvy decisions in this dynamic environment.

Categories

Recent Posts