Weekend Talking Points - 'Pause'

What’s Up with Real Estate?

National news and local views for the week ending Friday, January 31, 2025

National Real Estate News

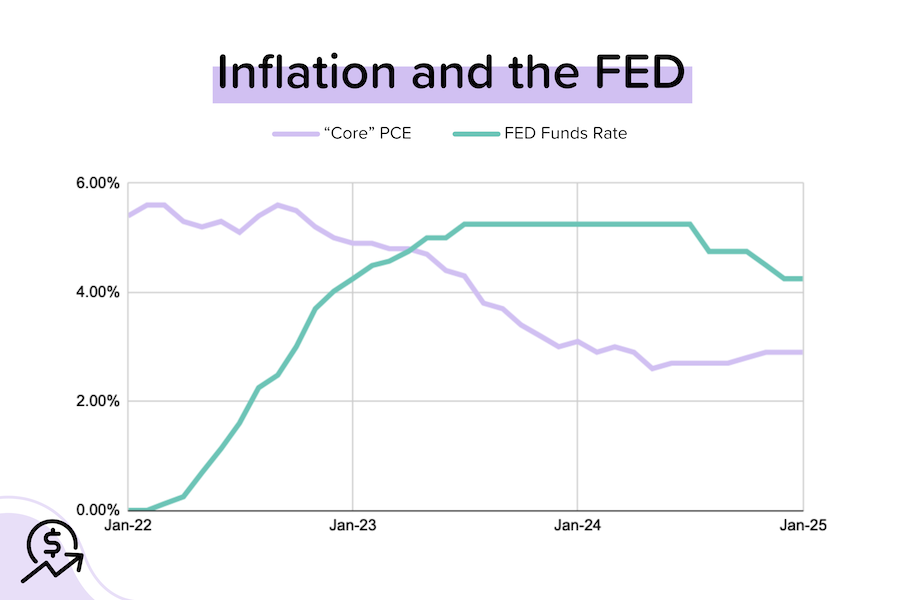

Fed presses 'pause'

Citing a 'solid' labor market and the recent lack of progress on getting the inflation rate lower, Federal Reserve members voted unanimously to keep the Fed Funds Rate steady at 4.25-4.50%. As a reminder, the Fed started this loosening cycle back in September 2024, cutting rates by a total of 100 basis points (1%) since then. [Source: Federal Reserve]

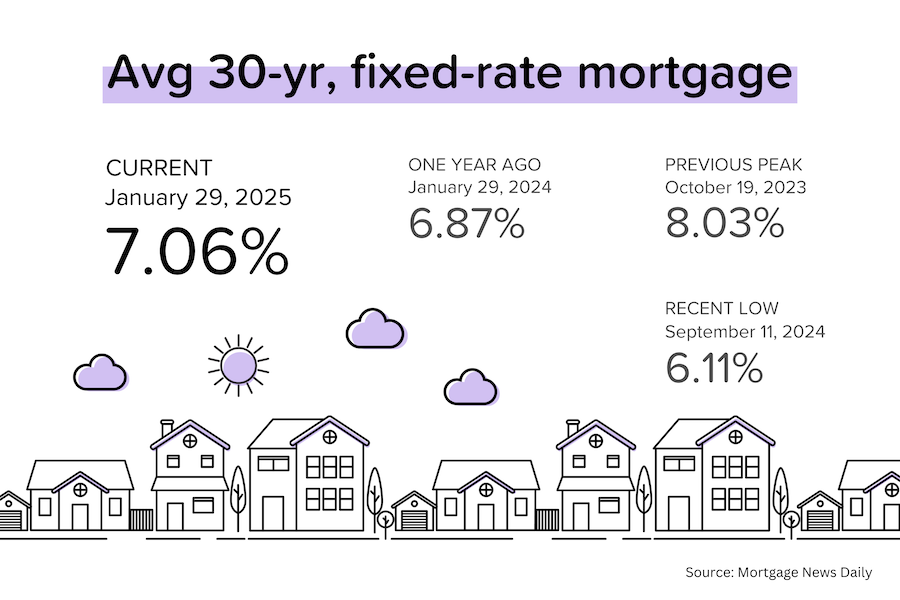

Rates drift lower

Since peaking around 7.25% in mid-January, the average 30-year mortgage rate has been slowly trending lower. That’s not because the latest inflation or employment data has been bullish for the bond market (it hasn’t been), but because of other factors: 1) the stock market sell-off spurred by China's DeepSeek, and 2) a growing belief that Trump's tariff threats are mostly negotiating tactics. [Source: Mortgage News Daily]

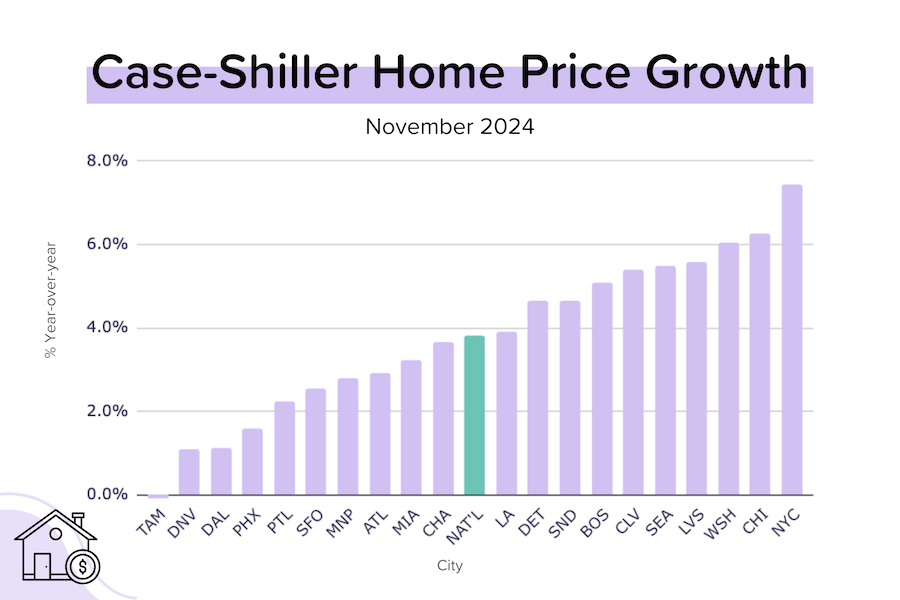

Prices keep rising

In November, Case-Shiller's national home price index rose 0.4% month-over-month to a new record. That meant that year-over-year growth actually accelerated from +3.7% to +3.8%. The strongest price growth continued to come from Northeastern (New York, D.C.) and Midwestern (Chicago, Cleveland) metros. The weakest from Seattle and Tampa. [Source: S&P DJI]

Categories

Recent Posts