Real Estate News in Brief

Hope is building for a more active spring/summer in terms of transaction volumes. Both real estate agents and new home builders are significantly more optimistic than they were at the same time last year, and existing home sales continued to recover in January.

Inflation for businesses rose (from a low level). The PPI (Producer Price Index) for January rose 0.3% MoM, adding to recent fears that inflation could be staging a comeback. [Bureau of Labor Statistics]

Housing starts dropped. January housing starts fell 15% month-over-month to an annualized rate of 1.3 million units, with multifamily starts down a massive 36% MoM. Single family starts, however, were only down 5% MoM and ROSE 22% YoY. [Census Bureau]

CoreLogic rent numbers for January. Single family rents grew +2.8% year-over-year in December 2023. More expensive rental markets saw the biggest moves, with San Francisco rents up 6.2% YoY. CoreLogic forecasts 2–4% YoY rental rate growth for 2024. [CoreLogic]

What the Fed said. The minutes (notes) from the last FOMC meeting showed that Fed members generally thought that rate hikes were over but that rate cuts shouldn’t be rushed without greater confidence that inflation was heading to their 2% target. [Federal Reserve]

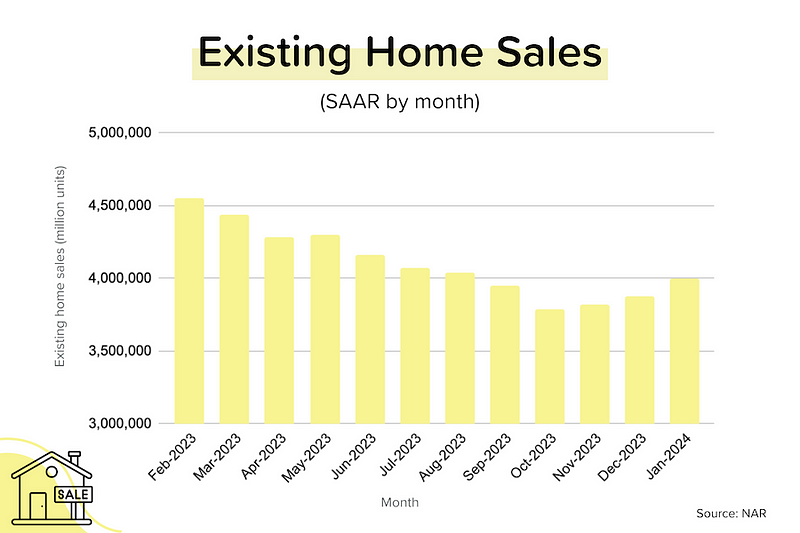

Buyer activity levels increased. Existing home sales rose 3.1% month-over-month in January 2024 to 4 million units (SAAR), as buyers reacted to lower mortgage rates in Nov/Dec 2023. The median sales price in January 2024 was $379K, up 5.0% year-over-year. [NAR]

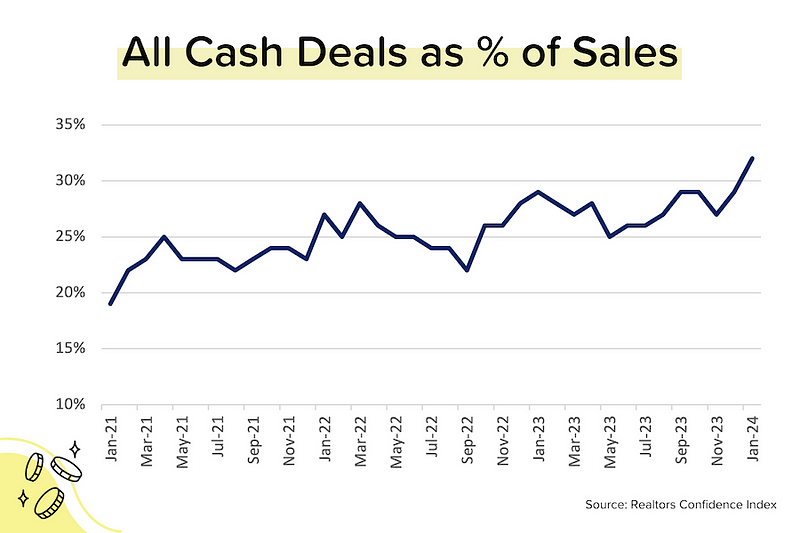

Great(er) expectations. The NAR’s Realtors Confidence Index for January 2024 showed rising agent optimism and increased levels of buyer competition, with 2.7 offers for every home sold in January, and a decade-high 32% of transactions being all-cash deals. More on this later. [NAR]

Confidence is Rising

The National Association of Realtors’ monthly Confidence Index is released on the same day as the existing home sales figure. Even though the RCI is just a survey, I find that it provides a wonderful perspective on the underlying supply/demand dynamics. Here’s what I took away from the January 2024 survey:

- Much more optimistic — In January 2024, 36% of respondents said that they expected to see a year-over-year increase in buyer traffic over the next 3 months. In January 2023, the same figure was 20%.

- Sellers say “show me the money!” — 32% of the homes purchased in January 2024 were all-cash deals. We haven’t seen a figure that high since 2014!

- But first-timers are still in the fight — 28% of the transactions in January 2024 were purchased by first-time buyers. While that’s lower than the 30–35% pre-pandemic, it goes to show that when people gotta move, they gotta move.

- Competition picking up — Like it does every year around this time, the number of offers per home sold picked up from 2.4x in December 2023 to 2.7x in January 2024. As a reminder, this figure peaked at 5.5x in April 2022!

- Reasonably-priced homes are still selling quickly — 53% of the homes sold in January 2024 were on the market for less than a month.

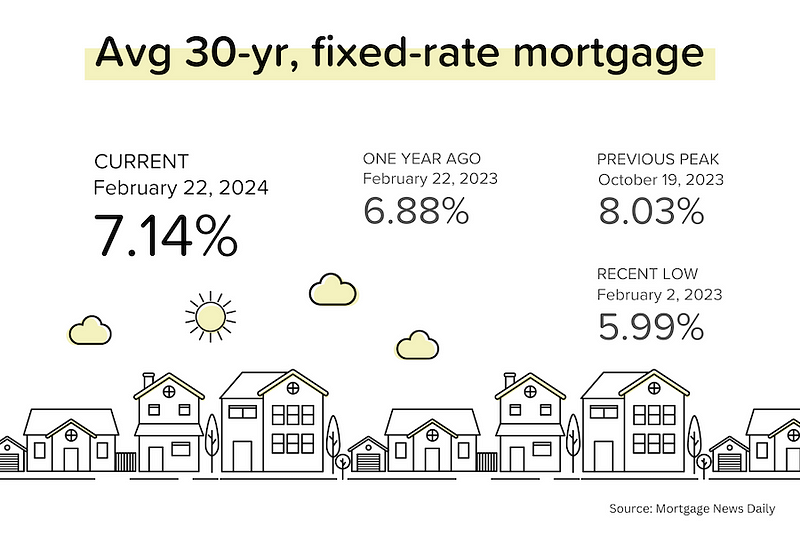

In conclusion: after two years of declining transaction volumes, real estate agents are hopeful (praying) for a recovery in 2024. The nearly 150 bps (1.5%) decline in average 30-yr mortgage rates between October 2023 and December 2023 has fueled this optimism. The uptick in inventory levels has helped as well. Competition levels are rising, but they are nowhere near where they were during the pandemic.

Mortgage Market

Average mortgage rates continued to climb last week, with the minutes from the last FOMC meeting showing that Fed members were more concerned about cutting rates too quickly than keeping them high for too long. The recent hotter-than-expected CPI and jobs figures certainly support that view.

It might surprise you to learn that refinances have been making up more than 30% of mortgage activity in recent weeks. How can that be? Doesn’t everyone have a rate below 5%? Well, not the people who bought homes in 2023!

Current odds of a Fed rate cut:

- March 20: 5% (basically nothing)

- May 1: 27% (still quite low)

- Jun 12: 67%

They Said It

“While home sales remain sizably lower than a couple of years ago, January’s monthly gain is the start of more supply and demand. Listings were modestly higher, and home buyers are taking advantage of lower mortgage rates compared to late last year.” — Lawrence Yun, NAR’s Chief Economist

“Mortgage rates moved back above 7 percent last week following news that inflation picked up in January, dimming hopes of a near-term rate cut. Mortgage applications dropped as a result with a larger decline in refinance applications. Potential homebuyers are quite sensitive to these rate changes, as affordability is strained with both higher rates and higher home values in this supply-constrained market.” — Mike Fratantoni, MBA’s SVP and Chief Economist

Source: Listresports, Inc.

Categories

Recent Posts